UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________ to _________

Commission file number 000-56228

IANTHUS CAPITAL HOLDINGS, INC.

(Exact name of registrant as specified in charter)

| British Columbia, Canada | 98-1360810 | |

| (State or jurisdiction of Incorporation or organization) |

I.R.S Employer Identification No. |

| 420 Lexington Avenue, Suite 414, New York, NY | 10170 | |

| (Address of principal executive offices) | (Zip code) |

(646) 518-9411

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None.

Securities registered pursuant to Section 12(g) of the Act: Common Shares, no par value.

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ☐

No ☒

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports),

and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant

to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that

the registrant was required to submit such files).

Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filter | ☐ | Accelerated filter | ☐ | |

| Non-accelerated filter | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act)

Yes ☐ No ☒

The aggregate market value of the voting stock and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter ended June 30, 2020 was $26,254,079 based upon the closing price of the registrant’s common shares of $0.18 on the OTC Pink Tier of the OTC Markets Group Inc. as of that date.

Number of common shares outstanding as of March 24, 2021 was 171,718,192.

Documents Incorporated by Reference: None.

Table of Contents

| Part I | ||

| Item 1. | Business | 8 |

| Item 1A. | Risk Factors | 24 |

| Item 1B. | Unresolved Staff Comments | 47 |

| Item 2. | Properties | 47 |

| Item 3. | Legal Proceedings | 48 |

| Item 4. | Mine Safety Disclosures | 51 |

| Part II | ||

| Item 5. | Market For Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 52 |

| Item 6. | Selected Financial Data | 52 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 53 |

| Item 7A. | Quantitative and Qualitative Disclosures about Market Risk | 62 |

| Item 8. | Financial Statements and Supplementary Data | 62 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 108 |

| Item 9A. | Controls and Procedures | 108 |

| Item 9B. | Other Information | 108 |

| Part III | ||

| Item 10. | Directors, Executive Officers and Corporate Governance | 109 |

| Item 11. | Executive Compensation | 113 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 118 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 121 |

| Item 14. | Principal Accountant Fees and Services | 123 |

| Part IV | ||

| Item 15. | Exhibits and Financial Statement Schedules | 124 |

| Signatures | 126 | |

-2-

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934 (the “Exchange Act”). Any statements in this Annual Report on Form 10-K about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common shares and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report on Form 10-K. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to the Annual Report on Form 10-K, completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof. Because the risk factors referred to on page 24 of Annual Report on Form 10-K, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these cautionary statements.

-3-

RISK FACTOR SUMMARY

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors,” together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occurs (or if any of those listed elsewhere in this Annual Report on Form 10-K occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Company

| • | We are a holding company and a majority of our assets are the capital stock of our subsidiaries. We rely on operators of our subsidiaries to execute on their business plans, produce cannabis products and otherwise conduct day to day operations. As a result, our cash flows are dependent upon the ability of our subsidiaries to operate successfully. |

| • | We rely on third-party suppliers, manufacturers and contractors to provide certain products and services, and due to the uncertain regulatory landscape for regulating cannabis in the United States, such third-parties may elect, at any time, to decline or withdraw services necessary for our operations and the operations of our subsidiaries. |

| • | Our business plan depends in part on our ability to continue merging with or acquiring other businesses in the cannabis industry, including cultivators, processors, manufacturers and dispensaries, and we may not be able to continue executing our merger and acquisition strategy successfully. |

| • | We compete for market share with other companies, which may have longer operating histories, more financial resources and more manufacturing and marketing experience than we do. In addition, we compete for market share with illicit cannabis businesses and other persons engaging in illicit cannabis-related activities. |

| • | Our U.S. tax classification could have a material adverse effect on our financial condition and results of operations. In addition, we may incur significant tax liabilities under section 280E of the U.S. Tax Code. |

| • | We have invested and may continue to invest in securities of private companies and may hold a minority interest in such companies, which may limit our ability to sell or otherwise transfer those securities and direct management decisions of such companies. |

| • | There is substantial doubt about our ability to continue as a going concern. |

| • | We will need additional capital to sustain our operations and will likely need to seek further financing, which may not be able on acceptable terms, if at all. If we fail to raise additional capital, as needed, our ability to implement our business model and strategy could be limited. |

| • | Servicing our debt will require a significant amount of cash, and we may not have sufficient cash flow from our business to pay our debt obligations. |

| • | We have outstanding debt instruments that are secured by a security interest in all of our assets and our failure to comply with the terms and covenants of such debt instruments could result in our loss of all of our assets. |

| • | We may face limitations on ownership of cannabis licenses as certain states limit not only the number of cannabis licenses issued, but also the number of cannabis licenses that one person or entity may own. |

-4-

| • | Our cannabis cultivation operations are vulnerable to rising energy costs and dependent upon key inputs. In addition, the cannabis and hemp industry is subject to the risks inherent in an agricultural business, including the risk of crop failure. |

| • | There is uncertainty surrounding the regulatory pathway for CBD. | |

| • | Our products are not approved by the FDA or any other federal governmental authority. |

| • | We are dependent on the popularity of consumer acceptance of cannabis and hemp products. |

| • | The presence of trace amounts of THC in our hemp products may cause adverse consequences to users of such products that will expose us to the risk of liability and other consequences. |

| • | We may have difficulty accessing the service of banks since cannabis and certain cannabis-related activities are illegal under U.S. federal law and certain state laws, which may make it difficult us to operate. |

| • | We may be subject to constraints on marketing our products. |

| • | Cannabis pricing and supply regulation may adversely affect our business. |

| • | High state and local excise and other taxes on cannabis products and compliance costs may adversely affect our business. |

| • | We can provide no assurance that we will obtain regulatory approvals required for us to proceed with the transactions contemplated by our contemplated recapitalization transaction or that such recapitalization transaction will be consummated pursuant to our plan of arrangement under the Business Corporations Act (British Columbia). |

| • | Our operations could be adversely affected by events outside of our control such as natural disasters, wars or health epidemics such as COVID-19. |

| • | The resignation of Hadley Ford as our Chief Executive Officer could have a material adverse impact on our business. |

| • | We may lack access to U.S. bankruptcy protections as many courts have denied cannabis businesses bankruptcy protections because the use of cannabis is illegal under federal law. |

| • | We may face difficulties in enforcing our contracts because our contracts involve cannabis and other activities that are not legal under federal law and in some state jurisdictions. |

| • | We may be subject to product liability claims and product recalls. |

| • | Third parties with whom we do business may perceive themselves as being exposed to reputational risk because of their relationship with us due to our cannabis-related business activities and may as a result, refuse to do business with us. |

| • | We may become subject to liability arising from fraudulent or illegal activity by our employees, independent contractors and consultants. |

| • | We may be subject to risks related to the protection and enforcement of our intellectual property rights, and third parties may enforce their intellectual property rights against us. |

-5-

| • | Financial reporting obligations of being a public company in Canada and the United States are expensive and time-consuming, and our management will be required to devote substantial time to compliance matters. |

Risks Related to Government Regulations

| • | The cannabis industry is highly regulated, and we may not always succeed in fully complying with applicable regulatory requirements in all jurisdictions where we operate. |

| • | Our business activities and the business activities of our subsidiaries, while believed to be compliant with applicable U.S. state and local laws, currently are illegal under U.S. federal law. |

| • | If we are not able to comply with all safety, security, health and environmental regulations applicable to our operations and industry, we may be held liable for any breaches thereof. |

| • | Our investments in the United States may be subject to heightened scrutiny by regulators, stock exchanges and other authorities in Canada and the United States. |

| • | U.S. border officers could deny entry into the United States to non-U.S. citizens who are employees of or investors in companies with cannabis operations in the United States or Canada. |

| • | U.S. State regulation of cannabis is uncertain. |

General Risk Factors

| • | There is a limited market for our common shares, and the market price of our common shares is volatile and may not accurately reflect the long term value of our Company. There is no assurance that an investment in our common shares will earn any positive return. |

| • | We have never paid dividends in the past and do not expect to declare or pay dividends in the foreseeable future. |

| • | Outstanding and future issuances of debt securities, which would rank senior to our common shares upon bankruptcy or liquidation, may adversely affect the level of return holders of common shares may be able to receive. |

| • | We are an “emerging growth company” and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our common shares less attractive to investors. |

-6-

PART I

Throughout this Annual Report on Form 10-K, references to “we,” “our,” “us,” the “Company,” or “iAnthus” refer to iAnthus Capital Holdings, Inc., a corporation organized under the laws of British Columbia, Canada, individually, or as the context requires, collectively with its subsidiaries.

THE COMPANY

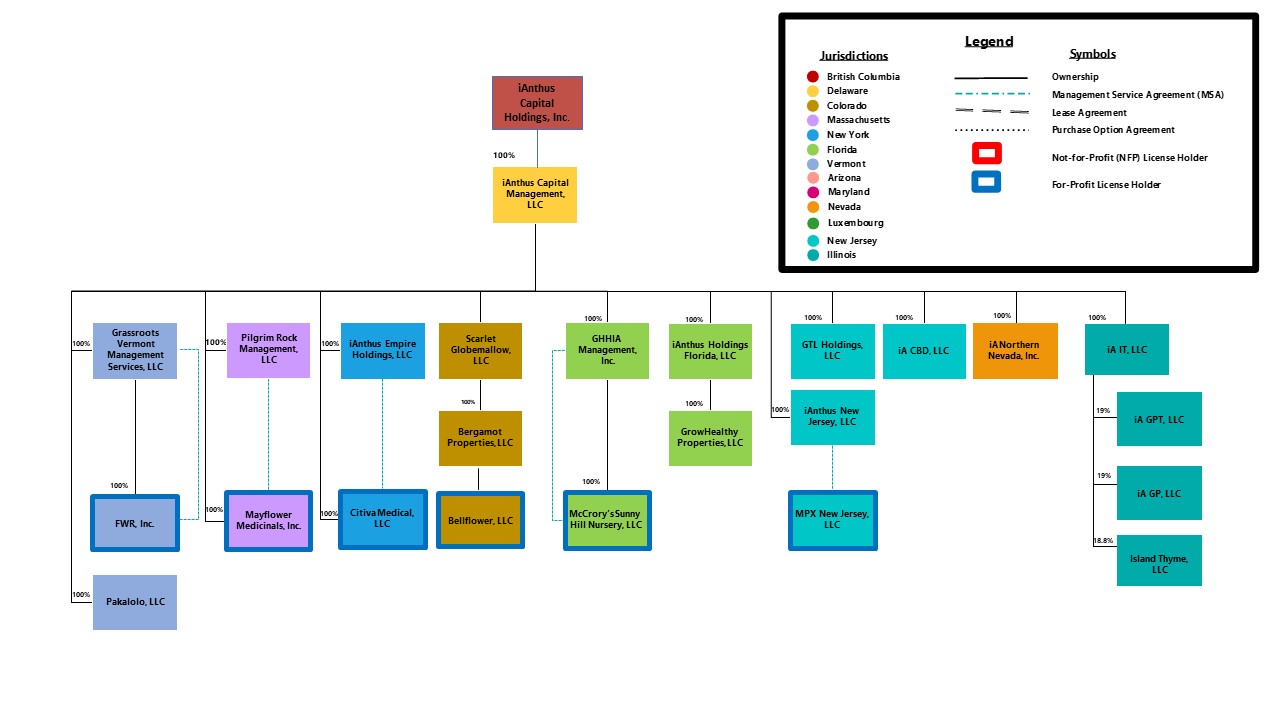

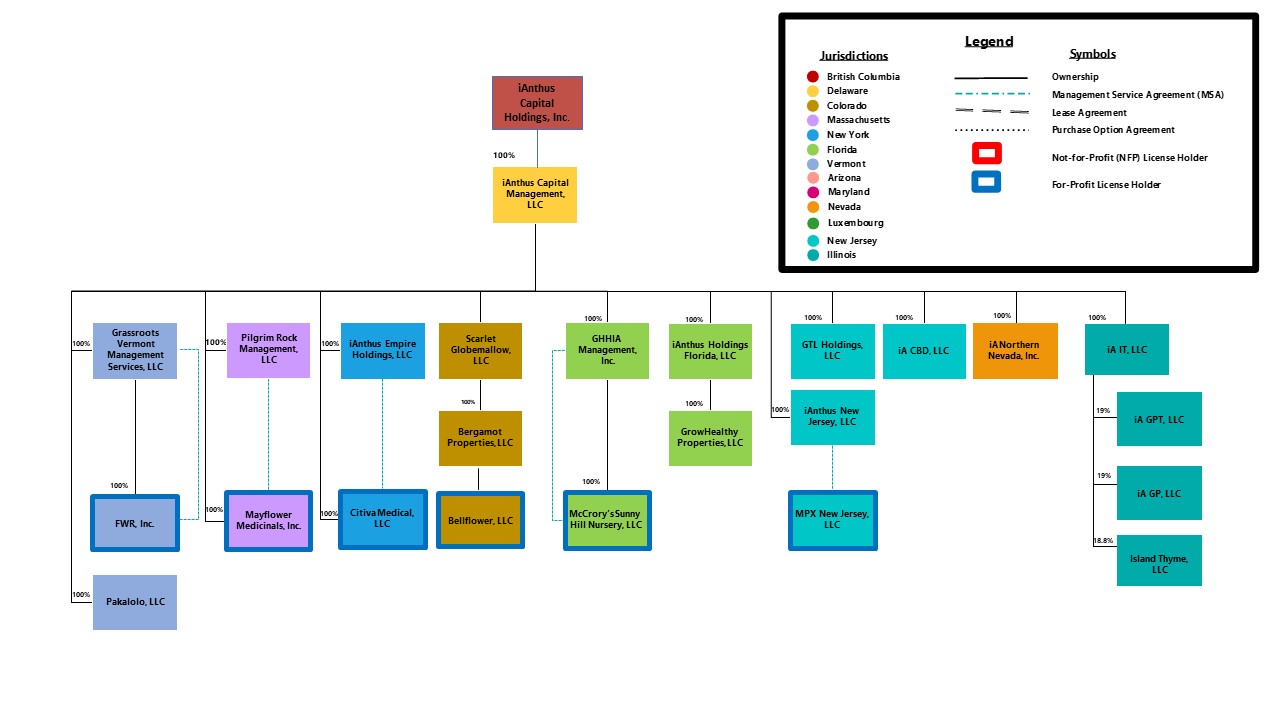

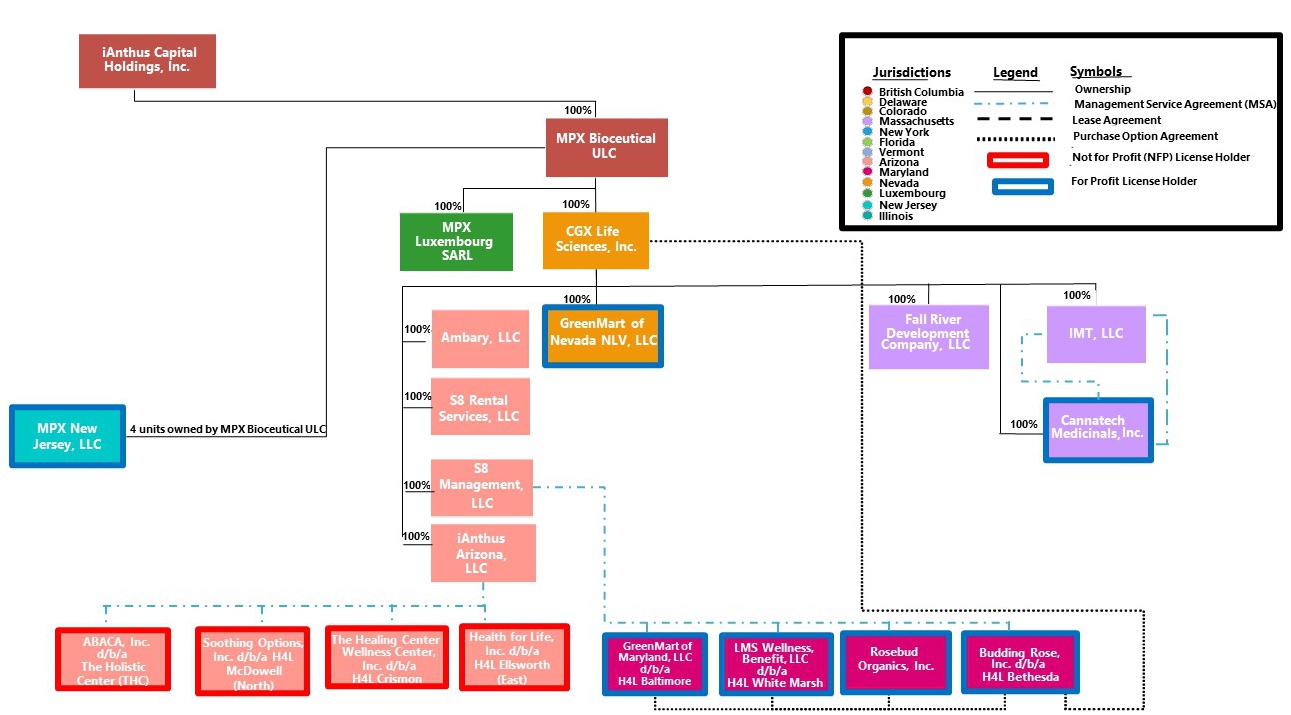

iAnthus Capital Holdings, Inc. (the “Company”) is a holding company with the subsidiaries set forth in the chart below.

-7-

ITEM 1. BUSINESS

Overview

We are a vertically-integrated, multi-state owner and operator of licensed cannabis cultivation, processing and dispensary facilities and a developer, producer and distributor of innovative branded cannabis and cannabidiol (“CBD”) products in the United States. Although we are committed to creating a national retail brand and portfolio of branded cannabis and CBD products recognized in the United States, cannabis currently remains illegal under U.S. federal law.

Through our subsidiaries, we currently own and/or operate 31 dispensaries and 10 cultivation and/or processing facilities in nine U.S. states. In addition, we distribute cannabis and CBD products to over 200 dispensaries and CBD products to over 2,300 retail locations throughout the United States. Pursuant to our existing licenses, interests and contractual arrangements, we have the capacity to own and/or operate up to an additional 12 dispensaries in five states, plus an uncapped number of dispensaries in Florida and up to 12 cultivation and/or processing facilities and we have the right to manufacture and distribute cannabis products in nine U.S. states.

Our multi-state operations encompass the full spectrum of medical and adult-use cannabis and CBD enterprises, including cultivation, processing, product development, wholesale-distribution and retail. Cannabis products offered by us include flower and trim, products containing cannabis flower and trim (such as pre-rolls), cannabis infused products (such as topical creams and edibles) and products containing cannabis extracts (such as vape cartridges, concentrates, live resins, wax products, oils and tinctures). Our CBD products include topical creams, tinctures and sprays and products designed for beauty and skincare (such as lotions, creams, haircare products, lip balms and bath bombs). Under U.S. federal law, cannabis is classified as a Schedule I controlled substance under the U.S. Controlled Substances Act (the “CSA”). A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety use under medical supervision and a high potential for abuse. Other than Epidiolex (cannabidiol), a cannabis-derived product, and three synthetic cannabis-related drug products (Marinol (dronabinol), Syndros (dronabinol) and Cesamet (nabilone)), the Food and Drug Administration (the “FDA”) has not approved a marketing application for cannabis for the treatment of any disease or condition and has not approved any cannabis, cannabis-derived or CBD products. See Risk Factor - Our products are not approved by the FDA.

-8-

Operations

Cultivation. We cultivate multiple strains of cannabis plants within our licensed cultivation facilities across the United States. We believe that our facilities are designed, managed and operated to cultivate high-quality products in a cost-effective manner. Our cultivation process uses all parts of the cannabis plant, including flower and trim (“biomass”), to produce cannabis products that we sell at our dispensaries and distribute to third parties on a wholesale basis. We currently have 12 issued cultivation and processing licenses in nine U.S. states, with approximately 417,000 square feet of cultivation and processing space which is fully built-out, approximately 400,000 square feet of space which is under construction and the ability to expand to a total of approximately 817,000 square feet of space within our existing lots. We currently have the ability to harvest approximately 56,000 pounds of biomass annually in our existing cultivation space, and we believe that we will have the ability to harvest approximately 195,000 pounds of biomass annually if we are able to use all of our projected cultivation space, including the cultivation space that is currently under construction and the additional unused cultivation space within our existing lots.

Product Development and Processing. We develop and sell cannabis products for medical and adult-use and CBD products for beauty and skincare. Biomass is processed into oil and resin that is used to develop numerous cannabis-extracted products, including vape pen oils, lotions, tinctures, other concentrates and edibles. We typically conduct product development and processing activities within our cultivation facilities and CBD products are manufactured in third-party manufacturing facilities. Processing procedures include developing formulations and packaging for all cannabis branded products, including the brands we own (such as Mayflower Medicinals, Black Label and Melting Point Extracts (MPX)), as well as brands that we manufacture and sell pursuant to our white label and/or licensing agreements.

Distribution.

Wholesale.

We distribute our cannabis products through our wholesale channel to over 200 dispensaries, including our own dispensaries. Our MPX and Black Label branded products are distributed in over 170 dispensaries in Arizona, Maryland and Nevada. Our CBD products, which are produced under the brand name CBD For Life, are distributed through a mass market retail model, including online at www.cbdforlife.us and in over 2,300 retail locations across the United States. Wholesale customers for our CBD products include dispensaries, local retailers and several national retailers. We also have distribution and sales partnerships for our CBD products.

Retail.

We currently own and/or operate 31 dispensaries for the sale of medical and/or adult-use cannabis, CBD and ancillary products. These dispensaries sell products that have been cultivated, developed and processed by us as well as third parties, in states where such sales are permitted. We own and/or operate licensed dispensaries in prime markets, including Baltimore, Bethesda, Boston, Brooklyn, Miami, Orlando, Phoenix, Staten Island and West Palm Beach, and we plan to open additional locations in other prime markets such as Atlantic City and Las Vegas.

-9-

Our Marijuana Dispensaries, Cultivation and Manufacturing

The table below provides a summary of our licensed operations:

| State | Licensed Entity | Type of Investment | Permitted Number of Facilities | |||

| Arizona | ABACA, Inc. (“ABACA”) The Healing Center Wellness Center, Inc. (“THCWC”) Health for Life, Inc. (“HFL”) Soothing Options, Inc. (“Soothing Options”) |

See Note 1 | 4 dispensaries2 8 cultivation2 8 processing2 | |||

| Colorado | See Note 3 | See Note 3 | See Note 3 | |||

| Florida | McCrory’s Sunny Hill Nursery, LLC (“McCrory’s”) | Ownership (100%)4 | No dispensary cap5 1 cultivation6 1 processing6 | |||

| Maryland | LMS Wellness, Benefit LLC (“LMS”) GreenMart of Maryland, LLC (“GMMD”) Rosebud Organics, Inc. (“Rosebud”) Budding Rose, Inc. (“Budding Rose”) |

See Note 7 | 3 dispensaries 1 processing | |||

| Massachusetts | Mayflower Medicinals, Inc. (“Mayflower”) Cannatech Medicinals, Inc. (“Cannatech”) |

Ownership (100%)8 | 3 medical dispensaries9 3 adult-use dispensaries9 3 medical cultivation/processing10 3 adult-use cultivation10 3 adult-use processing10 | |||

| Nevada | GreenMart of Nevada NLV, LLC (“GMNV”) | See Note 11 | 3 dispensaries11 1 cultivation12 1 processing12 | |||

| New Jersey | MPX New Jersey, LLC (“MPX NJ”) | See Note 13 | 3 dispensaries14 1 cultivation15 1 processing15 | |||

| New York | Citiva Medical, LLC (“Citiva”) | Ownership (100%) | 4 dispensaries16 1 cultivation16 1 processing16 | |||

| Vermont | FWR Inc. d/b/a Grassroots Vermont (“GRVT”) | Ownership (100%)17 | 2 dispensaries18 1 cultivation18 1 processing18 | |||

| United States | iA CBD, LLC (“iA CBD”) | Ownership (100%) | See Note 19 |

| (1) | ABACA, HFL, Soothing Options and THCWC are non-profit entities. Our wholly owned subsidiary, iAnthus Arizona, LLC (“iA AZ”), has entered into management agreements with ABACA, HFL, Soothing Options and THCWC, each of which holds an Arizona Medical Marijuana Dispensary Registration Certificate and a Marijuana Establishment License. |

| (2) | A holder of an Arizona Medical Marijuana Dispensary Registration Certificate and Marijuana Establishment License, also referred to as a dual license holder, permits its holder to operate one co-located medical and adult-use retail cannabis dispensary, which can be co-located with one medical or adult-use cannabis cultivation and manufacturing facility, two separately located cultivation and manufacturing facilities, and one separately located manufacturing, packaging, and storage facility. The Dispensary Registration Certificates and Marijuana Establish Licenses each held by ABACA, HFL, Soothing Options and THCWC, collectively allow for the operation of: (i) up to four co-located medical and adult-use cannabis retail dispensaries, (ii) up to four on-site cultivation facilities to cultivate and manufacturing cannabis and cannabis products; (iii) up to eight off-site cultivation facilities to cultivate and manufacture cannabis and cannabis products, and (iv) up to four off-site locations to manufacture, package, and store cannabis and cannabis products, all subject to regulatory approval. Through ABACA, HFL, Soothing Options and THCWC, we currently operate four medical cannabis dispensaries and three facilities for medical cannabis cultivation and processing, two of which are co-located with their affiliated dispensaries. We anticipate adult-use retail sales to begin at the start of the second quarter of 2021. In addition, Soothing Options has entered into a Cultivation Services Agreement with an unaffiliated, third-party, pursuant to which Soothing Options will license its off-site cultivation and processing license to the third-party, for a monthly fee and an option to purchase a set amount of biomass per month. |

-10-

| (3) | We do not currently have a license to operate a cannabis business in Colorado; however, on December 5, 2016, in related transactions, we, through our wholly-owned subsidiaries, Scarlet Globemallow, LLC (“Scarlet”) and Bergamot Properties, LLC (“Bergamot”) acquired certain non-cannabis assets of Organix, LLC (“Organix”) and the real estate holdings of Organix’s affiliate, DB Land Holdings, Inc., consisting of a 12,000 square foot cultivation facility in Denver, Colorado. Bergamot also purchased a dispensary located in Breckenridge, Colorado from a third-party. |

| (4) | We own 100% of GHHIA Management, Inc. (“GHHIA”), which holds an exclusive 40-year management agreement to operate the medical cannabis business associated with the Florida Medical Marijuana Treatment Center (“MMTC”) license issued to McCrory’s and held an option to acquire 100% of McCrory’s for a nominal consideration, which was subject to the approval of the Florida Department of Health. On August 14, 2019, the Florida Department of Health approved GHHIA’s option to acquire McCrory’s and GHHIA subsequently exercised the option. Accordingly, we, through our wholly-owned subsidiary GHHIA, now own 100% of McCrory’s. |

| (5) | Until April 1, 2020, Florida imposed a progressive limit on the number of medical cannabis dispensaries that could be operated by each vertically licensed MMTC based on the number of registered qualified medical cannabis patients in the state. This statutory cap, which permitted 25 dispensaries per MMTC, increasing by 5 dispensaries for each additional 100,000 patients registered in Florida’s Medical Marijuana Use Registry, expired on April 1, 2020. As of April 1, 2020, the MMTC license held by McCrory’s is no longer subject to the statutory cap. Through its vertically integrated MMTC license, McCrory’s currently operates 17 medical dispensaries in Florida. |

| (6) | Through its vertically integrated MMTC license, McCrory’s currently operates one co-located cultivation and processing facility located in Lake Wales, Florida. |

| (7) | Our wholly-owned subsidiary, S8 Management, LLC (“S8 Management”), has entered into management agreements with three medical cannabis dispensaries, LMS, Budding Rose, GMMD and one medical cannabis processor facility, Rosebud. Our wholly-owned subsidiary, CGX Life Sciences, Inc. (“CGX”), holds options to acquire the medical cannabis dispensary licenses and the medical cannabis processor license in the future, subject to regulatory approval. |

| (8) | We, through our wholly-owned subsidiary, iAnthus Capital Management, LLC (“ICM”), own 100% of Mayflower, which holds several medical and adult-use cannabis licenses. In addition, we, through our wholly-owned subsidiary CGX, own 100% of two separate management entities with service and consulting agreements with a second vertically integrated medical cannabis license holder, Cannatech. On October 8, 2020, we obtained approval from the Massachusetts Cannabis Control Commission (“CCC”) to convert Cannatech from a non-profit corporation to a for-profit corporation. On November 16, 2020, Cannatech was converted from a non-profit corporation to a for-profit corporation. As a result of the conversion, Cannatech is now owned 100% by the Company, through its wholly-owned subsidiary, CGX. In Massachusetts, an entity is permitted to control and operate up to three vertically-integrated medical Marijuana Treatment Center licenses, which include medical cultivation, product manufacturing and retail dispensing functions, up to three adult-use Marijuana Establishment cultivation licenses, up to three adult-use Marijuana Establishment product manufacturing licenses and up to three adult-use Marijuana Establishment retail licenses, with a maximum total cultivation “canopy” of up to 100,000 square feet. We, through Mayflower, currently hold one final vertically integrated medical license, one provisional vertically integrated medical license, one final adult-use cultivation license, one final adult-use product manufacturing license, one final adult-use retail license and one provisional adult-use retail license. Mayflower is also currently applying for a third provisional adult-use Marijuana Establishment retail license. In addition, Cannatech currently holds one provisional vertically integrated medical license and on October 8, 2020, Cannatech was granted one provisional adult-use Marijuana Establishment cultivation license and one provisional adult-use product manufacturing license. |

-11-

| (9) | We currently operate one Marijuana Treatment Center retail location, or medical dispensary, in Boston, Massachusetts and one Marijuana Establishment retail location, or adult-use dispensary, in Worcester, Massachusetts. We anticipate operating a total of three medical Marijuana Treatment Center retail locations in Boston, Lowell and Fall River, Massachusetts, subject to applicable regulatory approvals. In addition, we anticipate operating a total of three Marijuana Establishment retail locations, or adult-use dispensaries, in Worcester, Boston and Lowell, Massachusetts, two of which we expect will be co-located with our Marijuana Treatment Center retail locations in Boston and Lowell, Massachusetts subject to applicable regulatory approvals. On October 8, 2020, we obtained a final license to operate our Worcester, Massachusetts adult-use Marijuana Establishment retail location, which became operational on December 10, 2020 and exclusively maintains adult-use operations. |

| (10) | Our Holliston, Massachusetts facility currently includes the cultivation and product manufacturing operations of its final vertically integrated medical Marijuana Treatment Center license as well as the operations of its final adult-use Marijuana Establishment cultivation license and product manufacturing license. Subject to regulatory approval, we expect that our Holliston, Massachusetts facility will also include the cultivation and product manufacturing operations of our additional provisional vertically-integrated medical Marijuana Treatment Center license. Subject to regulatory approval, we expect that our Fall River, Massachusetts facility will include the cultivation and product manufacturing operations of the provisional vertically integrated medical Marijuana Treatment Center license held by Cannatech as well as the operations of a provisional adult-use Marijuana Establishment cultivation license and provisional adult-use product manufacturing license granted to Cannatech on October 8, 2020. Subject to applicable regulatory approval, we expect to operate cultivation and product manufacturing functions for three vertically integrated medical licenses, two adult-use cultivation licenses and two adult-use product manufacturing licenses out of two facilities in Holliston and Fall River, Massachusetts. We may also seek an additional adult-use cultivation license and an additional product manufacturing license within the Massachusetts statutory and regulatory limitations. |

| (11) | As a result of the acquisition of MPX Bioceutical Corporation on February 5, 2019 (the “MPX Acquisition”), we, through our wholly-owned subsidiary CGX, have acquired 99% of the ownership interests of GMNV, a licensed cultivation and production facility located in North Las Vegas, Nevada (the “NLV Facility”) that also holds three conditional dispensary licenses to be located in Henderson, Las Vegas and Reno, Nevada. On February 23, 2021, the Nevada Cannabis Compliance Board approved the change in control of GMNV resulting from the MPX Acquisition, including the acquisition of the remaining 1% ownership interest in GMNV. |

| (12) | GMNV currently has two Nevada medical cannabis establishment registration certificates, one for cultivation and one for production, each of which occurs at the NLV Facility. GMNV also currently has two Nevada adult-use licenses, one for cultivation and one for production, each of which also occurs at the same NLV Facility. |

| (13) | On August 27, 2019, iAnthus New Jersey, LLC (“INJ”), our wholly-owned subsidiary, entered into a financing, leasing, licensing and services agreement (the “Services Agreement”) with MPX NJ, which remains subject to regulatory approval by the New Jersey Department of Health (“NJDOH”). On October 24, 2019, INJ and MPX NJ entered into a loan agreement pursuant to which on October 16, 2019, MPX NJ issued INJ a convertible promissory note in the principal amount of $10,000,000 (the “INJ Note”). On February 3, 2021, INJ sent a notice of conversion to MPX NJ, notifying MPX NJ of INJ’s election to convert the entire principal amount outstanding of such note, plus all accrued and unpaid interest thereon, into such number of Class A units of MPX NJ representing 99% of the equity interest in MPX NJ. The conversion of INJ’s debt to equity is subject to approval by the NJDOH. On October 24, 2019, INJ, MPX NJ and the then-equityholders of MPX NJ entered into an option agreement, pursuant to which INJ was granted the option to acquire the remaining 1% of MPX NJ for nominal consideration, subject to regulatory approval, which option INJ exercised on February 25, 2021. |

-12-

| (14) | One medical dispensary is permitted under the current rules in New Jersey, with the possibility of operating two more satellite dispensaries subject to regulatory approval. On December 22, 2020, the NJDOH issued amended guidance that an initial application for a satellite dispensary must be submitted prior to January 2, 2021. On December 31, 2020, MPX NJ submitted two applications for two dispensary satellite locations. The satellite dispensary applications are subject to approval by the NJDOH. |

| (15) | MPX NJ cultivates medical cannabis at its Pleasantville, New Jersey facility, which is also expected to include processing capabilities. |

| (16) | We, through our wholly-owned subsidiary ICM, own 100% of Citiva, which holds a vertically integrated medical cannabis license allowing Citiva to operate one medical manufacturing facility, including cultivation and processing capabilities and up to four medical dispensaries. Citiva currently operates three medical dispensaries in Brooklyn, Wappingers Falls and Staten Island, New York. We anticipate operating one additional medical dispensary in Ithaca, New York and one manufacturing facility in Warwick, New York, subject to applicable regulatory approvals. |

| (17) | We own 100% of Grassroots Vermont Management Services, LLC (“GVMS”), the sole shareholder of GRVT, which has entered into a management services agreement with GRVT. Accordingly, we, through our wholly-owned subsidiary GVMS, own 100% of GRVT. |

| (18) | GRVT is a Vermont Registered Marijuana Dispensary, which permits GRVT to operate one vertically integrated location to cultivate, process and dispense medical cannabis and one additional dispensing location. GRVT currently operates one vertically integrated location where it cultivates, processes and dispenses medical cannabis in Brandon, Vermont. Subject to regulatory approval, GRVT anticipates opening an additional dispensing location in Burlington, Vermont. |

| (19) | On June 27, 2019, we, through our wholly-owned subsidiary, iA CBD, acquired substantially all of the property and assets of CBD For Life, LLC (“CBD For Life”). As a result of the acquisition of CBD For Life, iA CBD is engaged in the formulation, manufacture, creation and sale of products infused with CBD. The CBD used to manufacture these products is exclusively derived from hemp. We intend for all our hemp-derived products to be produced and sold in accordance with the 2014 Farm Bill and the 2018 Farm Bill, as applicable, at the time and location of operation and for such products to constitute hemp under the 2018 Farm Bill. |

Growth Strategies and Strategic Priorities

Expand retail footprint within existing dispensary license portfolio. We currently have 31 operating dispensaries; however, our licenses permit us to own and/or operate an additional 12 dispensaries in five states, plus an uncapped number of licenses in Florida, all subject to regulatory approval. We have dispensary licenses in key markets throughout the United States including New York City (Brooklyn and Staten Island), Boston, the Washington D.C. metro area (Bethesda), the Tampa and St. Petersburg area, Phoenix, the Miami and Fort Lauderdale area, Orlando, Baltimore and Las Vegas. We intend to expand our operations in Florida, Massachusetts, Nevada, New Jersey and New York.

Increase cultivation and processing capacity. We have 10 operational cultivation and processing licenses in nine states, with approximately 417,000 square feet of cultivation and processing space which is fully built-out, approximately 400,000 square feet of space which is under construction and the ability to expand to a total of approximately 817,000 square feet of space within our existing lots, subject to regulatory approval. We currently have the ability to harvest approximately 56,000 pounds of biomass annually in our existing cultivation space and we believe that we will have the ability to harvest approximately 195,000 pounds of biomass annually if we are able to use all of our projected cultivation space, including the cultivation space that is currently under construction and the additional unused cultivation space within our existing lots.

-13-

Increase patient and customer counts per location. We are focused on brand awareness and attracting new and existing patients and customers to our dispensaries and online ordering platforms. Our marketing and sales strategies include medical outreach, industry associations and websites, social media and a variety of other grassroots initiatives.

Acquire attractive targets to enhance our footprint, product offerings and/or operations. Strategic acquisitions are an important part of our ongoing growth strategy. We expect to continue to make strategic acquisitions that, among other things, are intended to increase revenue, build our geographic footprint, add new branded products to our portfolio and allow us to expand our capabilities and/or help improve operating efficiencies in existing markets.

Secure additional operating licenses throughout the United States. As more states legalize medical and/or adult-use cannabis products or expand their current cannabis regulations, new or additional cultivation, processing and/or dispensary licenses may become available. Given our operational history, we believe that we are well positioned to apply for any such new licenses.

Acquisitions

iA CBD, LLC

On June 27, 2019, we acquired substantially all of the assets and liabilities of CBD For Life through our wholly owned subsidiary, iA CBD, for consideration of $10.9 million (in cash and our common shares). As a result of this acquisition, we entered the CBD products market. We sell CBD For Life products directly to consumers online at www.cbdforlife.us as well as in over 2,300 retail locations across the United States.

MPX Bioceutical ULC

On February 5, 2019, we acquired the U.S. operations of MPX Bioceutical Corporation, which amalgamated into our-wholly owned subsidiary MPX Bioceutical ULC (“MPX”) for consideration of $533.1 million (in our common shares and common shares of a newly formed spin-out corporation which holds all of the non-U.S. cannabis businesses of MPX). In addition, we assumed certain debt instruments, warrants and options of MPX. As a result of the MPX Acquisition, we expanded our operations from six to ten states and added a robust portfolio of MPX-branded products. In addition, we acquired operations in Arizona, Nevada, Maryland and New Jersey and expanded our operations in Massachusetts.

Citiva Medical, LLC

On February 1, 2018, we acquired Citiva which holds one vertically integrated medical cannabis license in the state of New York for consideration of $24.8 million (in cash and our common shares). As a result of the acquisition of Citiva, we expanded our cannabis operations to New York and are permitted to operate one medical manufacturing facility, including cultivation and processing capabilities and up to four medical dispensaries in New York.

GrowHealthy Properties, LLC

On January 17, 2018, we acquired substantially all of the assets of GrowHealthy Properties, LLC (“GHP”) and McCrory’s (collectively “GrowHealthy”) for consideration of $58.3 million (in cash and our common shares). The transactions included the formation of iAnthus Holdings Florida, LLC and GHHIA, each a wholly-owned subsidiary of ICM, together with the purchase of GHP and an option to acquire 100% of McCrory’s for nominal consideration. On September 19, 2019, the option was exercised and 100% of the membership interest in McCrory’s was transferred to GHHIA. As a result of the acquisition of GrowHealthy, we expanded our cannabis operations to Florida and as a result of the acquisition of McCrory’s, we hold a medical marijuana treatment center license in the state of Florida that permits us to operate one or more cultivation and processing facilities and an unlimited number of dispensaries.

Mayflower and Pilgrim

On December 31, 2017, we acquired an 80% interest in Pilgrim Rock Management, LLC (“Pilgrim”) and on April 17, 2018, we acquired the remaining 20% interest in Pilgrim for consideration of an aggregate of 1,665,734 of our common shares. Pilgrim is an affiliated management company that provides management services, financing, intellectual property licensing, real estate, equipment leasing and certain other services to Mayflower. On July 31, 2018, Mayflower converted from a non-profit into a for-profit corporation and became our wholly-owned subsidiary. As a result of the acquisitions of Mayflower and Pilgrim, we expanded our cannabis operations to Massachusetts. Mayflower maintains one final vertically integrated medical license, one provisional vertically integrated medical license, one final adult-use cultivation license, one final adult-use product manufacturing license, one final adult-use retail license and one provisional adult-use retail license. Mayflower is also currently applying for a third provisional adult-use Marijuana Establishment retail license. Mayflower’s vertically integrated medical Marijuana Treatment Center license is comprised of a co-located cultivation and product manufacturing facility in Holliston, Massachusetts and a dispensary in Boston, Massachusetts. Mayflower’s adult-use operations include one adult-use Marijuana Establishment cultivation license and one adult-use Marijuana Establishment product manufacturing license, which are also co-located with Mayflower’s medical Marijuana Treatment Center cultivation and product manufacturing facility in Holliston, Massachusetts. In addition, Mayflower received its final adult-use Marijuana Establishment retail license for its Worcester, Massachusetts dispensary, which became operational on December 10, 2020 and exclusively maintains adult-use operations.

-14-

Competition

We compete on a state-by-state basis in the limited license medical and adult-use cannabis markets as well as the national CBD markets. Participation in state cannabis programs has significant regulatory and financial hurdles that create high barriers to entry, which result in a limited number of market participants in most states. In addition, most of the states in which we operate impose regulatory limitations on the number of cannabis licenses that can be granted, thus allowing for existing license holders to compete against a fixed number of regulated competitors in a particular market. We face competition from local regulated cannabis operators as well as illicit cannabis businesses and other persons engaging in illicit cannabis-related activities within each state. Our primary competitors include the following multi-state operators: Acreage Holdings, Inc., Cresco Labs Inc., Curaleaf Holdings Inc., Green Thumb Industries Inc., Harvest Health & Recreation, Inc., Trulieve Cannabis Corp., AYR Wellness Inc. and Verano Holdings Corp.

With respect to our CBD business, we compete with a growing number of emerging CBD companies including multi-state cannabis operators that also offer CBD products, as well as certain large national and multinational corporations that offer or plan to offer CBD products that are or may be deemed similar to those offered by us.

Financial Restructuring

The significant disruption of global financial markets, and specifically, the decline in the overall public equity cannabis markets due to the coronavirus (COVID-19) pandemic negatively impacted our ability to secure additional capital. Due to the liquidity constraints, we attempted to negotiate temporary relief of our interest obligations with the holders (the “Secured Lenders”) of our 13% senior secured convertible debentures (the “Secured Convertible Notes”) issued by ICM. However, we were unable to reach an agreement and did not make interest payments when due and payable to the Secured Lenders or payments that were due to the holders of our 8% convertible unsecured debentures (the “Unsecured Convertible Debentures” and together with the Secured Convertible Notes, the “Debentures”) (the “Unsecured Lenders” and together with the Secured Lenders, the “Lenders”). As of December 31, 2020, we are in default of our obligations pursuant to the Debentures which consists of $97.5 million and $60.0 million in principal amount plus accrued interest thereon of $15.1 million and $4.8 million with respect to the Secured Convertible Notes and Unsecured Convertible Debentures, respectively.

As a result of the default, all amounts, including principal and accrued interest, became immediately due and payable to the Lenders. Furthermore, as a result of the default, we also became obligated to pay an exit fee (the “Exit Fee”) of $10.0 million that accrues interest at a rate of 13% annually in relation to the Secured Convertible Notes, which exit fee, as of December 31, 2020, is $13.8 million. Upon payment of the Exit Fee, the holders of the Secured Convertible Notes issued in May 2018 (“Tranche One Secured Convertible Notes”) are required to transfer the 3,891,051 common shares issued under the $10.0 million equity financing that closed concurrently with the Tranche One Secured Convertible Notes to us. As of December 31, 2020, we have not paid the Exit Fee and such shares have not been transferred to us.

-15-

On June 22, 2020, we received a notice demanding repayment under the Secured Notes Purchase Agreement of the entire principal amount of the Secured Convertible Notes, together with interest, fees, costs and other charges that have accrued or may accrue from Gotham Green Admin 1, LLC, the collateral agent (the “Collateral Agent”) holding security for the benefit of the Secured Convertible Notes. The Collateral Agent concurrently provided us with a Notice of Intention to Enforce Security (the “BIA Notice”) under section 244 of the Bankruptcy and Insolvency Act (Canada) (the “BIA”). Pursuant to section 244 of the BIA, the Collateral Agent may not enforce the security over the collateral granted by us until ten days after sending the BIA Notice unless we consent to an earlier enforcement of the security.

On July 13, 2020, we entered into a restructuring support agreement (the “Restructuring Support Agreement”) with the Secured Lenders and a majority of the Unsecured Lenders (the “Consenting Unsecured Lenders”) to effectuate a proposed recapitalization transaction (the “Recapitalization Transaction”) to be implemented by way of a court-approved plan of arrangement (the “Plan of Arrangement”) under the Business Corporations Act (British Columbia) (the “BCBCA”) following approval by the Secured Lenders, Unsecured Lenders and our existing shareholders. Pursuant to Section 288(1) of the BCBCA, a company may propose an arrangement to its security holders (including shareholders and noteholders). To be effective, the arrangement must first be approved by the security holders of the company and then by the Supreme Court of British Columbia pursuant to a final arrangement approval order.

Pursuant to the Recapitalization Transaction, the Secured Lenders, the Unsecured Lenders and our shareholders are to be allocated and issued, approximately, such amounts of Restructured Senior Debt (as defined below), Interim Financing (as set forth below), 8% Senior Unsecured Convertible Debentures and percentage of our pro forma common shares, as presented in the following table:

| (in ’000s of U.S. dollars) | Restructured Senior Debt(1) |

Interim Financing(2) |

8% Senior Unsecured Debentures(3) |

Pro Forma Common Equity(4) |

||||||||||||

| Secured Lenders | $ | 85,000 | $ | 14,737 | $ | 5,000 | 48.625 | % | ||||||||

| Unsecured Lenders | – | – | 15,000 | 48.625 | % | |||||||||||

| Existing Shareholders | – | – | – | 2.75 | % | |||||||||||

| Total | $ | 85,000 | $ | 14,737 | $ | 20,000 | 100 | % | ||||||||

| (1) | The principal balance of the Secured Convertible Notes will be reduced to $85.0 million, which will be increased by the amount of the Interim Financing (as defined below), which has a first lien, senior secured position over all of our assets, is non-convertible and non-callable for three years and includes payment in kind at an interest rate of 8% per year and a maturity date which will be five years after the consummation of the Recapitalization Transaction (the “Restructured Senior Debt”). |

| (2) | The Secured Lenders provided $14.7 million of interim financing (the “Interim Financing”) to ICM, on substantially the same terms as the Restructured Senior Debt, net of a 5% original issue discount. The amounts of the Interim Financing along with any accrued interest thereon is expected to be converted into, and the original principal balance will be added to, the Restructured Senior Debt upon consummation of the Recapitalization Transaction. |

| (3) | The 8% Senior Unsecured Debentures include payment in kind at an interest rate of 8% per year, a maturity date which will be five years after the consummation of the Recapitalization Transaction, are non-callable for three years and are subordinate to the Restructured Senior Debt but senior to our common shares. |

| (4) | Following consummation of the Recapitalization Transaction, a to-be-determined amount of equity will be made available for management, employee and director incentives, as determined by the New Board (as defined below). All of our existing warrants and options will be cancelled and our common shares may be consolidated pursuant to a consolidation ratio which has yet to be determined. |

Upon consummation of the Recapitalization Transaction, a new board of directors (the “New Board”) will be composed of the following members: (i) three nominees will be designated by Gotham Green Partners, LLC and each of its affiliates and subsidiaries on behalf of the Secured Lenders; (ii) three nominees will be designated by each of the Consenting Unsecured Lenders as follows: one by Oasis Investments II Master Fund Ltd., one by Senvest Global (KY), LP and Senvest Master Fund, LP, and one by Hadron Healthcare and Consumer Special Opportunities Master Fund; and (iii) one nominee will be designated by the director nominees of the Secured Lenders and Consenting Unsecured Lenders to serve as a member of the New Board, who will also serve as our Chief Executive Officer.

-16-

Pursuant to the terms of the proposed Recapitalization Transaction, the Collateral Agent, the Secured Lenders and the Consenting Unsecured Lenders agreed to forbear from further exercising any rights or remedies in connection with any events of default that now exist or may in the future arise under any of the purchase agreements with respect of the Secured Convertible Notes and all other agreements delivered in connection therewith, the purchase agreements with respect of the Unsecured Convertible Debentures and all other agreements delivered in connection therewith and any other agreement to which the Collateral Agent, Secured Lenders, or Consenting Unsecured Lenders are a party to (collectively, the “Defaults”) and shall take such steps as are necessary to stop any current or pending enforcement efforts in relation thereto. Upon consummation of the Recapitalization Transaction, the Collateral Agent, Secured Lenders and Consenting Unsecured Lenders are also expected to irrevocably waive all Defaults and take all steps required to withdraw, revoke and/or terminate any enforcement efforts in relation thereto.

On September 14, 2020, our securityholders voted in support of the Recapitalization Transaction. Specifically, all of the holders of the Secured Convertible Notes and Unsecured Convertible Debentures voted in favor of the Plan of Arrangement. In addition, the holders of our common shares, options and warrants, representing 79.0% of the votes cast, voted in favor of the Plan of Arrangement.

On October 5, 2020, the Plan of Arrangement was approved by the Supreme Court of British Columbia, subject to the receipt of the Requisite Approvals (as defined below).

On November 3, 2020, Walmer Capital Limited, Island Investments Holdings Limited and Alastair Crawford collectively served and filed a Notice of Appeal with respect to the Court’s approval of the Plan of Arrangement, which appeal was dismissed by the British Columbia Court of Appeal on January 29, 2021.

Consummation of the Recapitalization Transaction through the Plan of Arrangement is subject to certain conditions, including: approval of our securityholders, which has been obtained; approval of the Plan of Arrangement by the Supreme Court of British Columbia, which has been obtained; and the receipt of all necessary state regulatory approvals in which we operate that require approval and approval by the CSE (collectively, the “Requisite Approvals”). Specifically, we will need to obtain approval from the following states: Florida, Nevada, Maryland, Massachusetts, New Jersey, New York and Vermont. To date, we have only received approval from the State of Nevada.

Subject to the consummation of the Recapitalization Transfer, we anticipate that we will have approximately 225 shareholders of record (as compared to 214 shareholders of record as of February 28, 2021, prior to the Recapitalization Transaction.) This does not include shares held in the name of a broker, bank or other nominees (typically referred to as being held in “street name”). In addition, pursuant to the Plan of Arrangement, we intend to issue up to an aggregate of 6,072,579,699 common shares upon the restructuring of (i) $22.5 million of Senior Secured Notes (including the Exit Fee) and $40.0 million of Unsecured Convertible Debentures, including interest accrued thereon and (ii) interest accrued on the Interim Financing. The issuance of common shares upon the consummation of the Plan of Arrangement would substantially increase the voting securities held of record by U.S. residents from approximately 50% to approximately 70%.

Recent Developments

New Jersey $11.0 Million Debt Financing

On February 2, 2021, INJ issued an aggregate of $11.0 million of senior secured bridge notes (“Senior Secured Bridge Notes”) which notes mature on the earlier of (i) February 2, 2023, (ii) the date on which we close a Qualified Financing and (iii) such earlier date that the principal amount may become due and payable pursuant to the terms of such notes. The Senior Secured Bridge Notes accrue interest at a rate of 14% per annum (decreasing to 8% per annum upon the completion of the Recapitalization Transaction (the “Effective Date”)) which interest is payable quarterly, and in kind, commencing on March 31, 2021. INJ and the holder of the Senior Secured Bridge Notes may mutually agree that all or part of the repayment of the Obligations (as defined in the Senior Secured Bridge Notes) be applied to the subscription price for our securities issued in connection with a Qualified Financing or otherwise, subject to approval by our board of directors and compliance with applicable laws; provided that such subscription for securities may occur only after the Effective Date. The Senior Secured Bridge Notes are secured by a security interest in certain assets of INJ. We have provided a guarantee in respect of all of the obligations of INJ under the Senior Secured Bridge Notes. “Qualified Financing” means a transaction or series of related transactions resulting in net proceeds to us of not less than $10.0 million from the subscription of our securities, including, but not limited to, a private placement or rights offering.

Intellectual Property

Our portfolio of subsidiaries currently includes a number of local brands; however, we intend to transition to a national model under fewer brands. As cannabis currently remains illegal under U.S. federal law, we cannot register our cannabis brands with the U.S. Patent and Trademark Office (“USPTO”). However, we rely on the intellectual property protections afforded under applicable state laws and common law through the use of our marks in commerce in each of the respective regions in which we operate.

-17-

Governmental Regulations

Cannabis

In the United States, the cultivation, manufacturing, importation, distribution, use and possession of cannabis is illegal under U.S. federal law. However, medical and adult-use cannabis has been legalized and regulated by individual states. Currently, 36 states plus the District of Columbia and certain U.S. territories recognize, in one form or another, the medical use of cannabis, while 15 of those states plus the District of Columbia and certain U.S. territories recognize, in one form or another, the full adult-use of cannabis. Notwithstanding the regulatory environment with respect to cannabis at the state level, cannabis continues to be categorized as a Schedule I controlled substance under the CSA. Accordingly, the use, possession, or distribution of cannabis violates U.S. federal law. As a result, cannabis businesses in the United States are subject to inconsistent state and federal legislation, regulation and enforcement.

Under former President Barack Obama, in an effort to provide guidance to U.S. federal law enforcement regarding the inconsistent regulation of cannabis at the U.S. federal and state levels, the U.S. Department of Justice (“DOJ”) released a memorandum on August 29, 2013 titled “Guidance Regarding Marijuana Enforcement” from former Deputy Attorney General James Cole (the “Cole Memorandum”). The Cole Memorandum acknowledged that, although cannabis is a Schedule I controlled substance under the CSA, the U.S. Attorneys in states that have legalized cannabis should prioritize the use of the U.S. federal government’s limited prosecutorial resources by focusing enforcement actions on the following eight areas of concern (the “Cole Priorities”):

| • | Preventing the distribution of marijuana to minors; |

| • | Preventing revenue from the sale of marijuana from going to criminal enterprises, gangs and cartels; |

| • | Preventing the diversion of marijuana from states where it is legal under state law in some form to other states; |

| • | Preventing state-authorized marijuana activity from being used as a cover or pretext for the trafficking of other illegal drugs or other illegal activity; |

| • | Preventing violence and the use of firearms in the cultivation and distribution of marijuana; |

| • | Preventing drugged driving and the exacerbation of other adverse public health consequences associated with marijuana use; |

| • | Preventing the growing of marijuana on public lands and the attendant public safety and environmental dangers posed by marijuana production on public lands; and |

| • | Preventing marijuana possession or use on U.S. federal property. |

In January 2018, under the administration of former President Donald Trump, former U.S. Attorney General Jeff Sessions rescinded the Cole Memorandum. While this did not create a change in U.S. federal law, as the Cole Memorandum was policy guidance and not law, the rescission added to the uncertainty of U.S. federal enforcement of the CSA in states where cannabis use is legal and regulated. Former Attorney General Sessions, concurrent with the rescission of the Cole Memorandum, issued a memorandum (“Sessions Memorandum”) which explained that the Cole Memorandum was “unnecessary” due to existing general enforcement guidance adopted in the 1980s, as set forth in the U.S. Attorney’s Manual (“USAM”). The USAM enforcement priorities, like those of the Cole Memorandum, are also based on the U.S. federal government’s limited resources and include law enforcement priorities set by the Attorney General, the seriousness of the alleged crimes, the deterrent effect of criminal prosecution and the cumulative impact of particular crimes on the community.

While the Sessions Memorandum emphasizes that cannabis is a Schedule I controlled substance under the CSA and states that it is a “dangerous drug and that marijuana activity is a serious crime,” it does not otherwise provide that the prosecution of cannabis-related offenses is now a DOJ priority. Furthermore, the Sessions Memorandum explicitly indicates that it is a guide for prosecutorial discretion and that discretion is firmly in the hands of U.S. Attorneys who determine whether to prosecute cannabis-related offenses. U.S. Attorneys could individually continue to exercise their discretion in a manner similar to that permitted under the Cole Memorandum. While certain U.S. Attorneys have publicly affirmed their commitment to proceeding in a manner contemplated under the Cole Memorandum, or otherwise affirmed that their views of U.S. federal enforcement priorities have not changed as a result of the rescission of the Cole Memorandum, others have publicly supported the rescission of the Cole Memorandum.

-18-

Under former Attorney General William Barr, the Department of Justice did not take a formal position on the federal enforcement of laws relating to cannabis. However, prior to his resignation on December 23, 2020, former Attorney General William Barr stated that his preference would be to have a uniform federal rule against cannabis, but, absent such a uniform rule, his preference would be to permit the existing federal approach leaving it up to the states to make their own decision. In addition, former Attorney General William Barr indicated that the DOJ was reviewing the Strengthening the Tenth Amendment Through Entrusting States Act (“STATES Act”), which would shield individuals and businesses complying with state cannabis laws from federal intervention.

On March 10, 2021, the Senate confirmed , President Joseph R. Biden’s nominee, Merrick Garland, to serve as Attorney General in his administration. Furthermore, two of President Biden’s nominees for top positions at the U.S. Department of Health and Human Services (“HHS”) have strong track records of supporting and defending state-legalized marijuana programs. California Attorney General Xavier Becerra, who was nominated to serve as the head of HHS, vowed to defend California’s legal cannabis market from any potential intervention during the Trump administration. Pennsylvania Secretary of Health Dr. Rachel Levine, who was nominated to serve as the assistant secretary of HHS, played a pivotal role in the implementation of Pennsylvania’s medical marijuana program. In addition, Democrats are generally more supportive of federal cannabis reform than Republicans. In the November 2020 election, the Democrats maintained their majority in the House of Representatives, although at a smaller margin than initially expected, and, as a result of the Georgia runoff elections in January 2021, have gained sufficient seats in the Senate to achieve control in the event of a Vice Presidential tie-breaking vote. Most notably, during the presidential campaign, President Biden stated that he supports decriminalizing marijuana. Despite the growing enthusiasm in the cannabis business community, it remains unclear whether the Department of Justice under President Biden and Attorney General Garland will re-adopt the Cole Memorandum or announce a substantive marijuana enforcement policy.

Other federal legislation provides or seeks to provide protection to individuals and businesses acting in violation of U.S. federal law but in compliance with state cannabis laws. For example, the Rohrabacher-Farr Amendment has been included in annual spending bills passed by Congress since 2014. The Rohrabacher-Farr Amendment restricts the DOJ from using federal funds to interfere with states implementing laws that authorize the use, distribution, possession, or cultivation of medical cannabis.

U.S. courts have construed these appropriations bills to prevent the U.S. federal government from prosecuting individuals or businesses engaged in cannabis-related activities to the extent they are operating in compliance with state medical cannabis laws. However, because this conduct continues to violate U.S. federal law, U.S. courts have observed that should the U.S. Congress choose to appropriate funds to prosecute individuals or businesses acting in violation of the CSA, such individuals or businesses could be prosecuted for violations of U.S. federal law even to the extent/even if they are operating in compliance with applicable state medical cannabis laws.

If Congress declines to include the Rohrabacher-Farr Amendment in future fiscal year appropriations bills or fails to pass necessary budget legislation causing a government shutdown, the U.S. federal government will have the authority to spend federal funds to prosecute individuals and businesses acting contrary to the CSA for violations of U.S. federal law.

Furthermore, the appropriations protections only apply to individuals and businesses operating in compliance with a state’s medical cannabis laws and provide no protection to individuals or businesses operating in compliance with a state’s adult-use cannabis laws. On June 20, 2019, however, the U.S. House of Representatives passed the Blumenauer-Norton-McClintock Amendment, which would expand the protections afforded by the Rohrabacher-Farr Amendment to individuals and businesses operating in compliance with applicable state adult-use cannabis laws. The U.S. Senate did not include the Blumenauer-McClintock-Norton Amendment in its appropriations bill, and ultimately, the Blumenauer-McClintock-Norton Amendment was not passed into law. On July 30, 2020, the U.S. House of Representatives again voted to include the Blumenauer-Norton-McClintock Amendment in the Commerce, Justice, Science and Related Agencies Appropriations Act, 2021. However, it is unclear whether the U.S. Senate will include the Blumenauer-McClintock-Norton Amendment in its version of the appropriations bill and whether it will ultimately be included in appropriations legislation for 2021.

-19-

Additionally, there are a number of marijuana reform bills that have been introduced in the U.S. Congress that would amend federal law regarding the legal status and permissibility of medical and adult-use cannabis, including the STATES Act, the Marijuana Opportunity Reinvestment and Expungement Act (the “MORE Act”), the Substance Regulation and Safety Act (the “SRSA”) and the Medical Marijuana Research Act (the “MMRA”). The STATES Act would create an exemption in the CSA to allow states to determine their own cannabis policies without fear of federal reprisal. The MORE Act, which was passed by the House Judiciary Committee on November 20, 2019, would remove cannabis from the CSA, expunge federal cannabis offenses and establish a 5% excise tax on cannabis to fund various federal grant programs. The SRSA, which was introduced by U.S. Senator Tina Smith on July 30, 2020, would remove cannabis from the CSA, grant the FDA authority to regulate cannabis and cannabis products and regulate the safety and quality control of cannabis crops and the import and export of cannabis materials. The MMRA, which was introduced by Representative Earl Blumenauer on July 17, 2019, would amend the CSA to make marijuana accessible for use by qualified marijuana researchers for medical purposes. On December 4, 2020, the House passed the MORE Act. Nevertheless, it is uncertain which federal marijuana reform bills, if any, will ultimately be passed and signed into law.

Businesses in the regulated cannabis industry, including our business, are subject to a variety of laws and regulations in the United States that involve money laundering, financial recordkeeping and proceeds of crime, including the U.S. Currency and Foreign Transactions Reporting Act of 1970 (“Bank Secrecy Act”) and the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (the “US PATRIOT Act”) and the rules and regulations thereunder and any related or similar rules, regulations, or guidelines, issued, administered, or enforced by governmental authorities in the United States. Further, under U.S. federal law, banks or other financial institutions that provide a cannabis business with a checking account, debit or credit card, small business loan, or any other service could be charged with money laundering, aiding and abetting, or conspiracy.

Despite these laws, the Financial Crimes Enforcement Network (“FinCEN”), a bureau within the U.S. Department of the Treasury (“U.S. Treasury”), issued a memorandum on February 14, 2014 (the “FinCEN Memorandum”), which provides instructions to banks and other financial institutions seeking to provide services to cannabis-related businesses. The FinCEN Memorandum explicitly references the Cole Priorities and indicates that in some circumstances it is permissible for banks and other financial institutions to provide services to cannabis-related businesses without risking prosecution for violation of U.S. federal money laundering laws. Under these guidelines, financial institutions are subject to a requirement to submit a suspicious activity report in certain circumstances as required by federal money laundering laws. These cannabis related suspicious activity reports are divided into three categories: marijuana limited, marijuana priority and marijuana terminated, based on the financial institution’s belief that the marijuana business follows state law, is operating out of compliance with state law, or where the banking relationship has been terminated, respectively. The FinCEN Memorandum refers to supplementary guidance in the Cole Memorandum relating to the prosecution of money laundering offenses predicated on cannabis-related violations of the CSA.

The rescission of the Cole Memorandum did not affect the status of the FinCEN Memorandum, and to date, the U.S. Treasury has not given any indication that it intends to rescind the FinCEN Memorandum. While the FinCEN Memorandum was originally intended to work in tandem with the Cole Memorandum, the FinCEN Memorandum appears to remain in effect as standalone guidance. Although the FinCEN Memorandum remains intact, indicating that the U.S. Treasury and FinCEN intend to continue abiding by its guidance, it is unclear whether the Biden administration will continue to follow the guidelines set forth under the FinCEN Memorandum.

In March 2019, the U.S. House of Representatives Financial Services Committee passed the Secure and Fair Enforcement Banking Act (the “SAFE Banking Act”) and the U.S. Senate held a hearing on the SAFE Banking Act in July 2019. On September 25, 2019, the U.S. House of Representatives passed the SAFE Banking Act. The SAFE Banking Act creates protections for financial institutions that provide banking services to businesses acting in compliance with applicable state cannabis laws, but it is uncertain whether it will be passed by the U.S. Senate and ultimately signed into law. On May 15, 2020, the U.S. House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions Act (the “HEROES Act”), which included the provisions of the SAFE Banking Act. The U.S. House of Representatives passed a more limited version of the HEROES Act on October 1, 2020, which also includes the provisions of the SAFE Banking Act. However, it is unclear whether the version of the HEROES Act to be passed by the U.S. Senate and ultimately signed into law will include the provisions of the SAFE Banking Act.

-20-

There can be no assurance that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. In addition, local and city ordinances may strictly limit and/or restrict the distribution of cannabis in a manner that could make it difficult or impossible to operate cannabis businesses in certain jurisdictions.

Hemp

On December 20, 2018, the U.S. Agriculture Improvement Act of 2018 (the “2018 Farm Bill”) was signed into law. Prior to its enactment, the U.S. federal government did not distinguish between cannabis and hemp and the entire plant species Cannabis sativa L. (subject to narrow exceptions applicable to specific portions of the plant) was scheduled as a controlled substance under the CSA. Therefore, the cultivation of hemp for any purpose in the United States without a Schedule I registration with the U.S. Drug Enforcement Agency (“DEA”) was federally illegal, unless exempted by Section 7606 of the Agricultural Act of 2014 (the “2014 Farm Bill”). The 2018 Farm Bill removed hemp (which is defined as “the plant Cannabis sativa L. and any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts and salts of isomers, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis”) and its derivatives, extracts and cannabinoids, including CBD derived from hemp, from the definition of marijuana in the CSA, thereby removing hemp and its derivatives from DEA purview as a controlled substance. The 2018 Farm Bill also amends the Agricultural Marketing Act of 1946 to allow for the commercial production of hemp in the United States under the purview of the United States Department of Agriculture (the “USDA”) in coordination with state departments of agriculture that elect to have primary regulatory authority over hemp production in their respective jurisdictions. Pursuant to the 2018 Farm Bill, states, U.S. territories and tribal governments may adopt their own regulatory plans for hemp production even if more restrictive than federal regulations so long as they meet minimum federal standards and are approved by the USDA. Hemp production in states and tribal territories that do not choose to submit their own plans and that do not prohibit hemp production will be governed by USDA regulation.