UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

For the fiscal year ended

|

For the transition period from |

|

to |

|

|

Commission file number

(Exact name of registrant as specified in charter)

British Columbia, |

|

(State or jurisdiction of Incorporation or organization) |

I.R.S. Employer Identification No. |

|

|

Toronto, |

|

(Address of principal executive offices) |

(Zip code) |

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

Accelerated filer |

☐ |

|

|

|

|

☒ |

Smaller reporting company |

||

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act) Yes ☐ No

The aggregate market value of the voting stock and non-voting common equity held by non-affiliates of the registrant as of the last business day of the registrant’s most recently completed second fiscal quarter ended June 30, 2023 was approximately $

Number of common shares outstanding as of March 21, 2024 was

Documents Incorporated by Reference: None.

Table of Contents

|

6 |

|

|

|

|

Item 1. |

7 |

|

|

|

|

Item 1A. |

25 |

|

|

|

|

Item 1B. |

46 |

|

|

|

|

Item 1C. |

46 |

|

|

|

|

Item 2. |

48 |

|

|

|

|

Item 3. |

49 |

|

|

|

|

Item 4. |

54 |

|

|

|

|

|

55 |

|

|

|

|

Item 5. |

55 |

|

|

|

|

Item 6. |

55 |

|

|

|

|

Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

56 |

|

|

|

Item 7A. |

69 |

|

|

|

|

Item 8. |

70 |

|

|

|

|

Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

119 |

|

|

|

Item 9A. |

119 |

|

|

|

|

Item 9B. |

120 |

|

|

|

|

Item 9C. |

Disclosure Regarding Foreign Jurisdictions that Prevent Inspections |

120 |

|

|

|

|

121 |

|

|

|

|

Item 10. |

121 |

|

|

|

|

Item 11. |

125 |

|

|

|

|

Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

130 |

|

|

|

Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

132 |

|

|

|

Item 14. |

133 |

|

|

|

|

|

135 |

|

|

|

|

Item 15. |

135 |

|

|

|

|

Item 16. |

137 |

|

|

|

|

|

138 |

2

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Any statements in this Annual Report on Form 10-K about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “estimate,” “intend,” “plan” and “would.” For example, statements concerning financial condition, possible or assumed future results of operations, growth opportunities, industry ranking, plans and objectives of management, markets for our common shares and future management and organizational structure are all forward-looking statements. Forward-looking statements are not guarantees of performance. They involve known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to differ materially from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement.

Any forward-looking statements are qualified in their entirety by reference to the risk factors discussed throughout this Annual Report on Form 10-K. You should read this Annual Report on Form 10-K and the documents that we reference herein and have filed as exhibits to the Annual Report on Form 10-K completely and with the understanding that our actual future results may be materially different from what we expect. You should assume that the information appearing in this Annual Report on Form 10-K is accurate as of the date hereof. Because the risk factors referred to on page 24 of Annual Report on Form 10-K could cause actual results or outcomes to differ materially from those expressed in any forward-looking statements made by us or on our behalf, you should not place undue reliance on any forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict which factors will arise. We cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of the information presented in this Annual Report on Form 10-K, and particularly our forward-looking statements, by these cautionary statements.

3

RISK FACTOR SUMMARY

Our business is subject to significant risks and uncertainties that make an investment in us speculative and risky. Below we summarize what we believe are the principal risk factors relating to our company but these risks are not the only ones we face, and you should carefully review and consider the full discussion of our risk factors in the section titled “Risk Factors,” together with the other information in this Annual Report on Form 10-K. If any of the following risks actually occur (or if any of those listed elsewhere in this Annual Report on Form 10-K occur), our business, reputation, financial condition, results of operations, revenue, and future prospects could be seriously harmed. Additional risks and uncertainties that we are unaware of, or that we currently believe are not material, may also become important factors that adversely affect our business.

Risks Related to Our Company

4

Risks Related to Government Regulations

Risks Related to our Securities

General Risk Factors

5

PART I

Throughout this Annual Report on Form 10-K, references to “we,” “our,” “us,” the “Company,” or “iAnthus” refer to iAnthus Capital Holdings, Inc., a corporation organized under the laws of British Columbia, Canada, individually, or as the context requires, collectively with its subsidiaries.

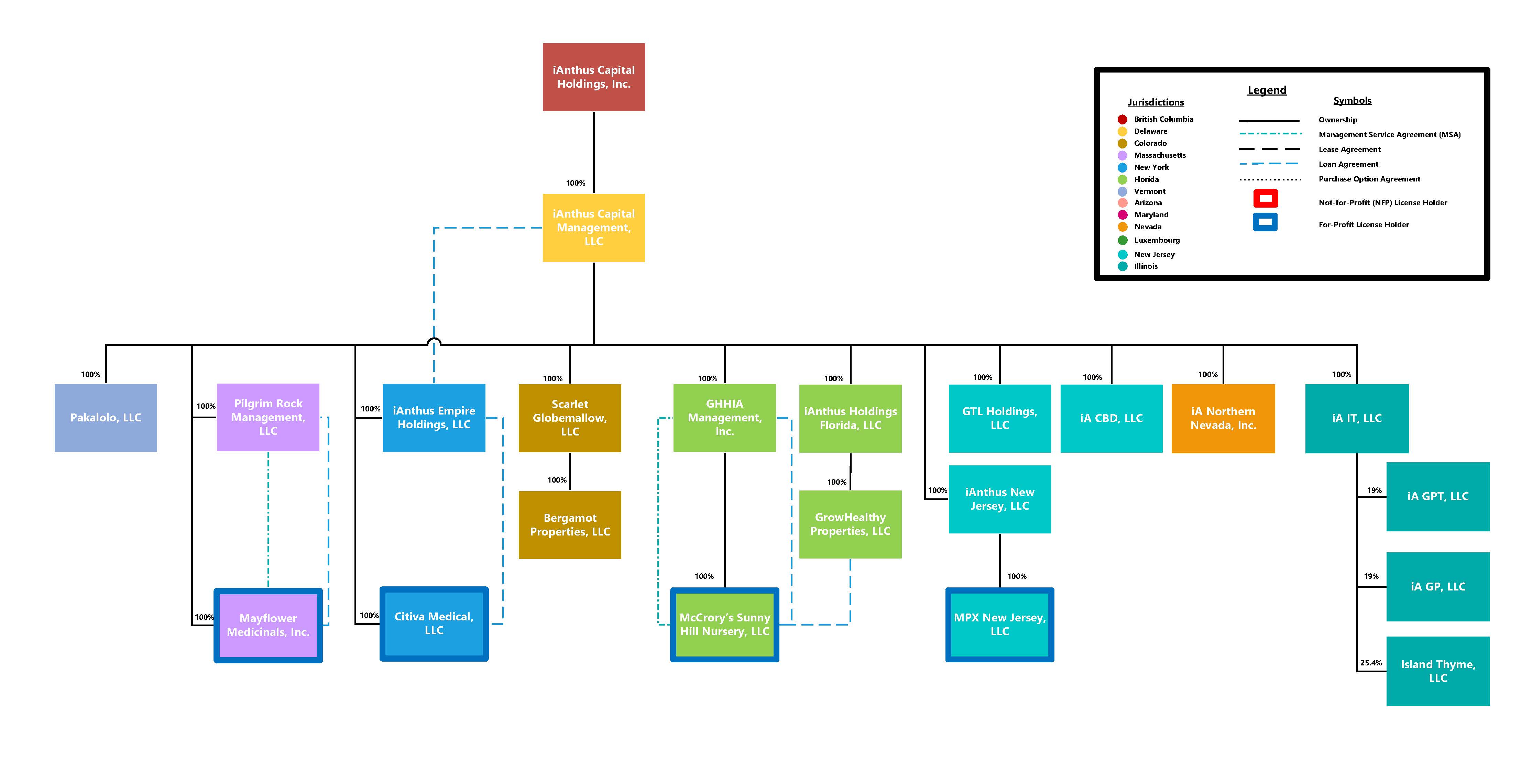

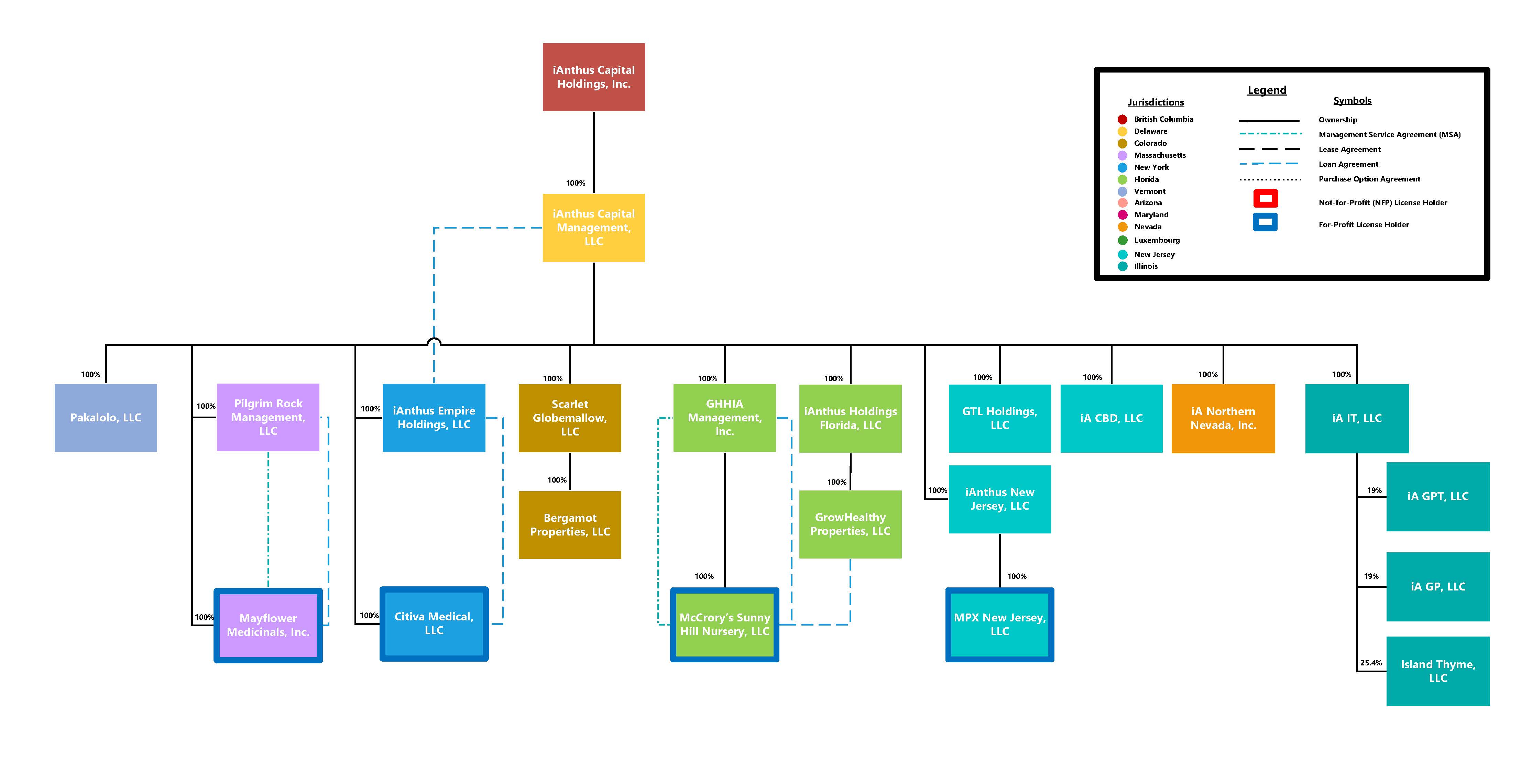

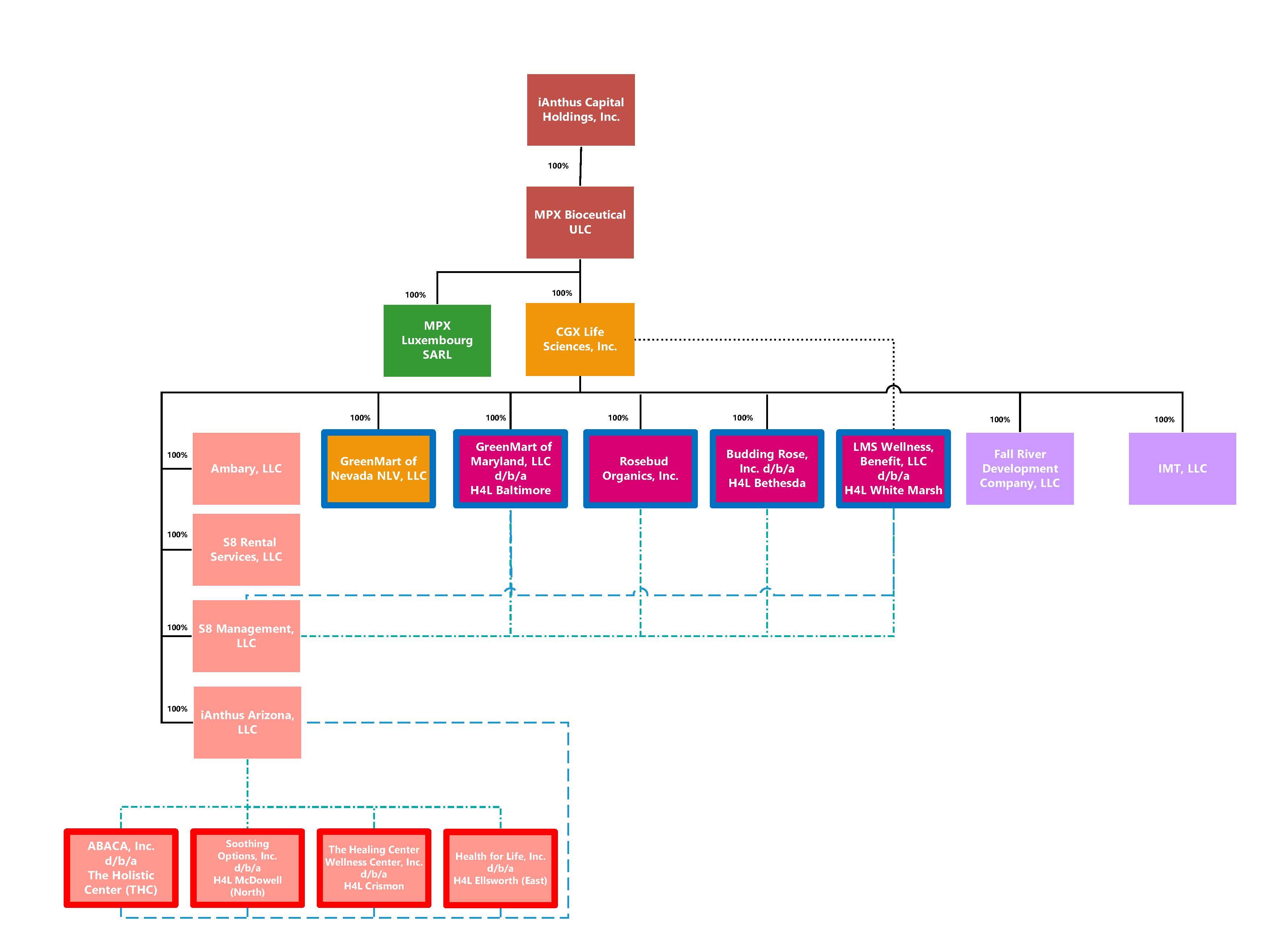

THE COMPANY

iAnthus Capital Holdings, Inc. (the “Company”) is a holding company with the subsidiaries set forth in the chart below.

6

ITEM 1. BUSINESS

Overview

We are a vertically-integrated, multi-state owner and operator of licensed cannabis cultivation, processing and dispensary facilities and a developer, producer and distributor of innovative branded cannabis products in the United States. Although we are committed to creating a national retail brand and portfolio of branded cannabis products recognized in the United States, cannabis currently remains illegal under U.S. federal law.

Through our subsidiaries, we currently own and/or operate 37 dispensaries and eight cultivation and/or processing facilities in seven U.S. states. Pursuant to our existing licenses, interests and contractual arrangements, we have the capacity to own and/or operate up to an additional five dispensary licenses and/or dispensary facilities in two states, plus an uncapped number of dispensaries in Florida and up to 18 cultivation, manufacturing and/or processing facilities, and we have the right to manufacture and distribute cannabis products in eight U.S. states, all subject to the necessary regulatory approvals.

Our multi-state operations encompass the full spectrum of medical and adult-use cannabis enterprises, including cultivation, processing, product development, wholesale-distribution and retail. Cannabis products offered by us include flower and trim, products containing cannabis flower and trim (such as packaged flower and pre-rolls), cannabis infused products (such as topical creams and edibles) and products containing cannabis extracts (such as vape cartridges, concentrates, live resins, wax products, oils and tinctures). Under U.S. federal law, cannabis is classified as a Schedule I controlled substance under the U.S. Controlled Substances Act (the “CSA”). A Schedule I controlled substance is defined as a substance that has no currently accepted medical use in the United States, a lack of safety use under medical supervision and a high potential for abuse. Other than Epidiolex (cannabidiol), a cannabis-derived product, and three synthetic cannabis-related drug products (Marinol (dronabinol), Syndros (dronabinol) and Cesamet (nabilone)), the Food and Drug Administration (the “FDA”) has not approved a marketing application for cannabis for the treatment of any disease or condition and has

7

not approved any cannabis, cannabis-derived products. See Risk Factor – Our products are not approved by the FDA or any other federal governmental authority.

Operations

Cultivation. We cultivate multiple strains of cannabis plants within our licensed cultivation facilities across the United States. We believe that our facilities are designed, managed and operated to cultivate high-quality products in a cost-effective manner. Our cultivation process uses all parts of the cannabis plant, including flower and trim (“biomass”), to produce cannabis products that we sell at our dispensaries and distribute to third parties on a wholesale basis. We currently have eight issued cultivation and processing licenses in seven U.S. states, with approximately 482,000 square feet of cultivation and processing space which is fully built-out and the ability to expand to a total of approximately 956,000 square feet of space within our existing lots, subject to regulatory approval. We currently have the ability to harvest approximately 41,000 pounds of biomass annually in our existing cultivation space, and we believe that we will have the ability to harvest approximately 150,000 pounds of biomass annually if we are able to use all of our projected cultivation space, including the cultivation space that is currently under construction and the additional unused cultivation space within our existing lots.

Product Development and Processing. We develop and sell cannabis products for medical and adult-use. Biomass is processed into oil and resin that is used to develop numerous cannabis-extracted products, including vape pen oils, lotions, tinctures, other concentrates and edibles. We typically conduct product development and processing activities within our cultivation facilities. Processing procedures include developing formulations and packaging for all cannabis branded products, including the brands we own (such as GrowHealthy, Black Label and Melting Point Extracts (MPX)), as well as brands that we manufacture and sell pursuant to our white label and/or licensing agreements.

Distribution

Wholesale

We distribute our cannabis products through our wholesale channel to over 155 dispensaries, including our own dispensaries and other third-party dispensaries in Arizona, Maryland, Massachusetts, New Jersey and Nevada. These include our MPX and Black Label branded products.

8

Retail

We currently own and/or operate 37 dispensaries for the sale of medical and/or adult-use cannabis and ancillary products. These dispensaries sell products that have been cultivated, developed and processed by us as well as third parties, in states where such sales are permitted. We own and/or operate licensed dispensaries in prime markets, including Atlantic City, Baltimore, Bethesda, Boston, Brooklyn, Las Vegas, Miami, Orlando, Phoenix, Staten Island and West Palm Beach, and we plan to open additional locations in the future.

Our Marijuana Dispensaries, Cultivation and Manufacturing

The table below provides a summary of our licensed operations:

State |

|

Licensed Entity |

|

Type of Investment |

|

Permitted Number of Facilities |

Arizona |

|

ABACA, Inc. (“ABACA”) |

|

See Note 1 |

|

4 dispensaries2 |

Florida |

|

McCrory’s Sunny Hill Nursery, LLC |

|

Ownership (100%)3 |

|

No dispensary cap4 |

Illinois |

|

Island Thyme, LLC (“Island Thyme”) |

|

Ownership (25.41%)6 |

|

2 adult-use dispensaries7 |

Maryland |

|

LMS Wellness, Benefit LLC (“LMS”) |

|

See Note 8 |

|

3 dispensaries |

Massachusetts |

|

Mayflower Medicinals, Inc. (“Mayflower”) |

|

Ownership (100%)9 |

|

3 medical dispensaries10 |

Nevada |

|

GreenMart of Nevada NLV, LLC |

|

Ownership (100)%12 |

|

3 dispensaries13 |

New Jersey |

|

MPX New Jersey LLC (“MPX NJ”) |

|

Ownership (100%)14 |

|

3 dispensaries15 |

New York |

|

Citiva Medical, LLC (“Citiva”) |

|

Ownership (100%)17 |

|

8 dispensaries17 |

9

Growth Strategies and Strategic Priorities

Expand retail footprint within existing dispensary license portfolio. We currently have 37 operating dispensaries; however, our licenses permit us to own and/or operate an additional five dispensary licenses and/or dispensary facilities in six states, plus an uncapped number

10

of licenses in Florida, all subject to regulatory approval. We have dispensary licenses in key markets throughout the United States including New York City (Brooklyn and Staten Island), Boston, the Washington D.C. metro area (Bethesda), the Tampa and St. Petersburg area, Phoenix, the Miami and Fort Lauderdale area, Orlando, Baltimore and Las Vegas. We intend to expand our operations in Florida and New York.

Increase cultivation and processing capacity. We have eight operational cultivation and/or processing facilities in seven states, with approximately 482,000 square feet of cultivation and processing space which is fully built-out, and the ability to expand to a total of approximately 956,000 square feet of space within our existing lots, subject to regulatory approval. We currently have the ability to harvest approximately 41,000 pounds of biomass annually in our existing cultivation space and we believe that we will have the ability to harvest approximately 150,000 pounds of biomass annually if we are able to use all of our projected cultivation space, including the cultivation space that is currently under construction and the additional unused cultivation space within our existing lots.

Increase patient and customer counts per location. We are focused on brand awareness and attracting new and existing patients and customers to our dispensaries and online ordering platforms. Our marketing and sales strategies include medical outreach, industry associations and websites, social media and a variety of other grassroots initiatives.

Develop and introduce new products to increase wallet share. We produce and sell a wide array of cannabis products from our own cultivation and processing facilities, and continue to innovate to add to our product line in various states. Through investment in new equipment, brands and processes, we continue to introduce new products to sell to our retail and wholesale customers within our existing footprint in order to offer a wider array of choices to our patients and customers as they build their baskets.

Acquire attractive targets to enhance our footprint, product offerings and/or operations. Strategic acquisitions are an important part of our ongoing growth strategy. We expect to continue to make strategic acquisitions that, among other things, are intended to increase revenue, build our geographic footprint, add new branded products to our portfolio and allow us to expand our capabilities and/or improve operating efficiencies in existing markets.

Secure additional operating licenses throughout the United States. As more states legalize medical and/or adult-use cannabis products or expand their current cannabis regulations, new or additional cultivation, processing and/or dispensary licenses may become available. Given our operational history, we believe that we are well positioned to apply for any such new licenses.

Acquisitions

GreenMart of Maryland, LLC, Rosebud Organics, Inc. and Budding Rose, Inc.

In January 2018, we, through our wholly-owned subsidiary, CGX, entered into separate option agreements, as amended, with (i) all of the shareholders (the “Budding Rose Sellers”) of Budding Rose; (ii) all of the shareholders (the “Rosebud Sellers”) of Rosebud; (iii) Elizabeth Stavola (the “GMMD Seller”), our former officer and director and the sole member of GMMD; and (iv) William Huber, the sole member of LMS (the “LMS Seller”) and LMS, pursuant to which, CGX was granted and exercised its options to acquire 100% ownership of Budding Rose, Rosebud, GMMD and LMS on September 16, 2021, April 1, 2021, November 5, 2021 and November 22, 2021, respectively, all subject to regulatory approval by the Maryland Medical Cannabis Commission (the “MMCC”). On July 28, 2022, the MMCC approved CGX’s request to acquire 100% ownership of Budding Rose, Rosebud and GMMD. On August 9, 2022, CGX closed on its acquisition of GMMD, and on August 18, 2022, CGX closed on its acquisitions of Rosebud and Budding Rose.

On May 23, 2022, we, through CGX, filed a demand for arbitration with the American Arbitration Association against LMS and the LMS Seller for various breaches under the option agreements entered into between CGX and LMS, on the one hand, and CGX and the LMS Seller on the other (collectively, the “LMS Option Agreements”). The closing of our acquisition of LMS is subject to the resolution of this pending legal matter. See “Item 3. Legal Proceedings - Claim by Maryland License Holder” for additional information.

MPX New Jersey LLC

On February 1, 2022, we, through our wholly-owned subsidiary INJ, acquired 100% ownership of MPX NJ, which holds medical and adult-use cannabis licenses. On October 24, 2019, INJ and MPX NJ entered into a loan agreement pursuant to which on October 16, 2019, MPX NJ issued to INJ the INJ Note. On February 3, 2021, INJ sent a notice of conversion to MPX NJ, notifying MPX NJ of INJ’s election to convert the entire principal amount outstanding of such note, plus all accrued and unpaid interest thereon, into such number of Class A units of MPX NJ representing 99% of the equity interest in MPX NJ. On October 24, 2019, INJ, MPX NJ and the then-equityholders of MPX NJ entered into an option agreement, pursuant to which INJ was granted the option to acquire the remaining 1% of MPX NJ for nominal consideration, which INJ exercised on February 25, 2021. On January 7, 2022, the CRC approved the conversion of INJ’s debt into a 99% equity interest in MPX NJ and INJ’s acquisition of the remaining 1% of MPX NJ. As a result of

11

the acquisition of MPX NJ, we expanded our cannabis operations to New Jersey and currently operate one co-located medical and adult-use cultivation and manufacturing facility and three co-located medical and adult-use dispensaries.

iA CBD, LLC

On June 27, 2019, we acquired substantially all of the assets and liabilities of CBD For Life through our wholly-owned subsidiary, iA CBD, LLC ("iA CBD") for consideration of $10.9 million (in cash and our common shares). As a result of this acquisition, we entered the cannabidiol ("CBD") products market under the brand name "CBD for Life". See "Dispositions- iA CBD" below. On May 8, 2023, iA CBD entered into an Asset Purchase Agreement with a third-party, C4L, LLC (the "Buyer"), pursuant to which, iA CBD agreed to sell substantially all the assets of iA CBD, subject to certain closing conditions. On August 15, 2023, we completed the sale of substantially all the assets of iA CBD. As a result of the sale, we no longer produce, develop or distribute CBD products.

MPX Bioceutical ULC

On February 5, 2019, we acquired the U.S. operations of MPX Bioceutical Corporation, which amalgamated into our wholly-owned subsidiary MPX Bioceutical ULC (“MPX”) for consideration of $533.1 million (in our common shares and common shares of a newly formed spin-out corporation which holds all of the non-U.S. cannabis businesses of MPX) (the "MPX Acquisition"). In addition, we assumed certain debt instruments, warrants and options of MPX. As a result of the MPX Acquisition, we acquired our operations in Arizona, Nevada, Maryland and New Jersey and expanded our operations in Massachusetts. In addition, we added a robust portfolio of MPX-branded products.

Citiva Medical, LLC

On February 1, 2018, we acquired Citiva, which holds one vertically integrated medical cannabis license in the state of New York for fair market value consideration of $24.8 million (in cash and our common shares). As a result of the acquisition of Citiva, we expanded our cannabis operations to New York and are permitted to operate one medical manufacturing facility, including cultivation and processing capabilities and up to a maximum of eight medical dispensaries in New York, subject to regulatory approval. As of January 12, 2024, Citiva received approval for its ROD license, which allows us to expand into adult-use operations in New York, subject to the payment of certain licensing fees.

GrowHealthy Properties, LLC

On January 17, 2018, we acquired substantially all of the assets of GrowHealthy Holdings, LLC (including GrowHealthy Properties, LLC (“GHP”) and McCrory’s) for fair market value consideration of $58.3 million (in cash and our common shares). The transactions included the formation of iAnthus Holdings Florida, LLC and GHHIA, each a wholly-owned subsidiary of ICM, together with the purchase of GHP and an option to acquire 100% of McCrory’s for nominal consideration. On September 19, 2019, the option was exercised and 100% of the membership interest in McCrory’s was transferred to GHHIA. As a result of this asset acquisition, we expanded our cannabis operations to Florida and as a result of the acquisition of McCrory’s, we hold a medical marijuana treatment center license in the state of Florida that permits us to operate one or more cultivation and processing facilities and an unlimited number of dispensaries.

Mayflower Medicinals, Inc. and Pilgrim Rock Management, LLC

On December 31, 2017, we acquired an 80% interest in Pilgrim Rock Management, LLC (“Pilgrim”) and on April 17, 2018, we acquired the remaining 20% interest in Pilgrim for consideration of an aggregate of 1,665,734 of our common shares. Pilgrim is an affiliated management company that provides management services, financing, intellectual property licensing, real estate, equipment leasing and certain other services to Mayflower. On July 31, 2018, Mayflower converted from a non-profit into a for-profit corporation and became our wholly-owned subsidiary. As a result of the acquisitions of Mayflower and Pilgrim, we expanded our cannabis operations to Massachusetts. Mayflower maintains one final vertically integrated medical license, one provisional vertically integrated medical license, two final adult-use cultivation licenses, two final adult-use product manufacturing licenses and three final adult-use retail licenses. Effective as of June 30, 2023, Mayflower merged with our wholly-owned subsidiary, Cannatech Medicinals, Inc. ("Cannatech"). In connection with this internal merger, Mayflower relocated its co-located cultivation and product manufacturing facility from Holliston, Massachusetts to Fall River, Massachusetts. Mayflower's final vertically integrated medical Marijuana Treatment Center license is comprised of its co-located cultivation and product manufacturing facility in Fall River, Massachusetts and a dispensary in Boston, Massachusetts. As a result of the internal merger with Cannatech, Mayflower’s adult-use operations include two adult-use Marijuana Establishment cultivation licenses and two adult-use Marijuana Establishment product manufacturing licenses. One of each of Mayflower's adult-use Marijuana Establishment cultivation licenses and Marijuana Establishment product manufacturing licenses are also co-located with Mayflower’s medical Marijuana Treatment Center cultivation and product manufacturing facility in Fall River, Massachusetts. Mayflower's second adult-use Marijuana Establishment cultivation license and Marijuana Establishment product

12

manufacturing license that are associated with Mayflower's former co-located cultivation and product manufacturing facility located in Holliston, Massachusetts are under contract for sale to a third-party.

Dispositions

Vermont Operations

On February 6, 2023, ICM entered into a Membership Interest Purchase Agreement (the “MIPA”) with an unaffiliated third-party buyer (the “VT Buyer”) for the sale of all of the issued and outstanding membership interests of Grassroots Vermont Management Services, LLC ("GVMS") for $0.2 million (the “GVMS Sale”), subject to certain adjustments set forth in the MIPA. The closing of the MIPA was subject to customary closing conditions, including approval by the Vermont Cannabis Control Board (the “CCB”). On February 6, 2023, ICM, GVMS and FWR, Inc. ("FWR") entered into a management agreement (the “Management Agreement”) with the VT Buyer, which went into effect on March 8, 2023. Pursuant to the Management Agreement, the VT Buyer will manage the operations of FWR until the closing of the GVMS Sale. The Management Agreement terminates upon the earlier of the closing of the GVMS Sale or termination of the MIPA. As of August 14, 2023, all closing conditions of the MIPA were satisfied, including the receipt of approval from the CCB, and ICM completed the GVMS Sale on that date.

iA CBD

On May 8, 2023, our wholly-owned subsidiary, iA CBD, entered into an Asset Purchase Agreement (the "Purchase Agreement") with C4L, LLC (the "CBD Buyer"), pursuant to which, iA CBD agreed to sell substantially all of the assets of iA CBD for $0.2 million. iA CBD owns and operates the Company's assets associated with its CBD products branded as CBD for Life (the "CBD Business"). The closing of the Purchase Agreement was subject to, among other customary conditions, the assignment of the United States Small Business Loan held by iA CBD. On May 8, 2023, iA CBD also entered into an interim management agreement (the "CBD Management Agreement"), pursuant to which the Buyer assumed full operational and managerial control of the Business as of May 8, 2023 (the "CBD Effective Date"). The CBD Management Agreement remained in effect until the earlier of the (i) closing of the Purchase Agreement; and (ii) the termination of the Purchase Agreement in accordance with its terms. As of the CBD Effective Date, all operational control of the CBD Business was transferred to the CBD Buyer. As of August 15, 2023, the Company completed the sale of iA CBD as all closing conditions of the Purchase Agreement were satisfied, including receipt of approval of the assignment of the United States Small Business Loan.

Colorado Investments

We, through our wholly-owned subsidiaries, Scarlet Globemallow, LLC ("Scarlet") and Bergamot Properties, LLC ("Bergamot"), held certain investments in Colorado, including real estate. As of November 14, 2023, Scarlet and Bergamot each sold their respective Colorado-related interests collectively for $2.7 million.

Competition

We compete on a state-by-state basis in the limited license medical and adult-use cannabis markets. Participation in state cannabis programs has significant regulatory and financial hurdles that create high barriers to entry, which result in a limited number of market participants in most states. In addition, most of the states in which we operate impose regulatory limitations on the number of cannabis licenses that can be granted, thus allowing for existing license holders to compete against a fixed number of regulated competitors in a particular market. We face competition from local regulated cannabis operators as well as illicit cannabis businesses and other persons engaging in illicit cannabis-related activities within each state. Our primary competitors include the following multi-state operators: Acreage Holdings, Inc., Cresco Labs Inc., Curaleaf Holdings Inc., Green Thumb Industries Inc., Trulieve Cannabis Corp., AYR Wellness Inc. and Verano Holdings Corp.

Financial Restructuring

The significant disruption of global financial markets, and specifically, the decline in the overall public equity cannabis markets due to the coronavirus (“COVID-19”) pandemic negatively impacted our ability to secure additional capital, which caused liquidity constraints. In early 2020, due to the liquidity constraints, we attempted to negotiate temporary relief of our interest obligations with the holders (the “Secured Lenders”) of our 13% senior secured convertible debentures (the “Secured Notes”) issued by ICM. However, we were unable to reach an agreement and did not make interest payments when due and payable to the Secured Lenders or payments that were due to the holders of our 8% convertible unsecured debentures (the “Unsecured Debentures” and together with the Secured Notes, the “Debentures”) (the “Unsecured Lenders” and together with the Secured Lenders, the “Lenders”). As a result, we defaulted on our obligations pursuant to the Secured Notes and the Unsecured Debentures.

13

On June 22, 2020, we received a notice demanding repayment under the Amended and Restated Debenture Purchase Agreement dated October 10, 2019 (the “Secured Notes Purchase Agreement”) of the entire principal amount of the Secured Notes, together with interest, fees, costs and other charges that have accrued or may accrue from Gotham Green Admin 1, LLC, the collateral agent (the “Collateral Agent”) holding security for the benefit of the Secured Notes. The Collateral Agent concurrently provided us with a Notice of Intention to Enforce Security under section 244 of the Bankruptcy and Insolvency Act (Canada).

On July 10, 2020, we entered into a restructuring support agreement (as amended, the “Restructuring Support Agreement”) with the Secured Lenders and a majority of the Unsecured Lenders (the “Consenting Unsecured Lenders”) to effectuate a recapitalization transaction (the “Recapitalization Transaction”). Closing of the Recapitalization Transaction through an amended and restated plan of arrangement (the “Plan of Arrangement”) was subject to certain conditions, including: approval of the Secured Lenders, Unsecured Lenders and existing holders of our common shares, warrants, and options; approval of the Plan of Arrangement by the Supreme Court of British Columbia; and the receipt of all necessary state regulatory approvals in which we operate that require approval and approval by the CSE (collectively, the “Requisite Approvals”). All Requisite Approvals required to consummate the Recapitalization Transaction were satisfied, conditioned, or waived by us, the Secured Lenders and the Consenting Unsecured Lenders, and on June 24, 2022 (the “Closing Date”), we closed the Recapitalization Transaction pursuant to the Plan of Arrangement under the Business Corporations Act (British Columbia) approved by the Supreme Court of British Columbia. Pursuant to the terms of the Restructuring Support Agreement, the Collateral Agent, the Secured Lenders and the Consenting Unsecured Lenders agreed to forbear from further exercising any rights or remedies in connection with any events of default that existed or may have existed in the future arise under any of the purchase agreements with respect to the Secured Notes and all other agreements delivered in connection therewith, the purchase agreements with respect to the Unsecured Debentures and all other agreements delivered in connection therewith and any other agreement to which the Collateral Agent, Secured Lenders, or Consenting Unsecured Lenders are a party to (collectively, the “Defaults”). As of the Closing Date, the Collateral Agent, Secured Lenders and Consenting Unsecured Lenders irrevocably waived all Defaults. In August 2021, Gotham Green Partners, LLC and the Collateral Agent filed a Notice of Application (with the Ontario Superior Court of Justice, which sought, among other things, a declaration that the outside date for closing the Recapitalization Transaction be extended, which extension was granted by such court and we subsequently appealed. Following the closing of the Recapitalization Transaction, we discontinued the appeal with prejudice.

In connection with the closing of the Recapitalization Transaction, we issued an aggregate of 6,072,579,705 common shares to the Secured Lenders and Unsecured Lenders. Specifically, we issued 3,036,289,852 common shares (the “Secured Lender Shares”), or 48.625% of our outstanding common shares, to the Secured Lenders and 3,036,289,853 common shares (the “Unsecured Lender Shares” and together with Secured Lender Shares, the “Shares”), or 48.625% of our outstanding common shares, to the Unsecured Lenders. As of the Closing Date, we had 6,244,297,897 common shares issued and outstanding and existing holders of our common shares collectively held 171,718,192 common shares, or 2.75% of our outstanding common shares.

As of the Closing Date, the outstanding principal amount of the Secured Notes (including the interim financing secured notes in the aggregate principal amount of approximately $14.7 million originally due on July 13, 2025 (the “Interim Financing”)) together with interest accrued and fees thereon were forgiven in part and exchanged for (A) the Secured Lender Shares, (B) June Secured Debentures (as defined below) in the aggregate principal amount of $99,736,842 and (C) June Unsecured Debentures (as defined below) in the aggregate principal amount of $5.0 million. In addition, as of the Closing Date, the outstanding principal amount of the Unsecured Debentures together with interest accrued and fees thereon were forgiven in part and exchanged for (A) the Unsecured Lender Shares and (B) June Unsecured Debentures in the aggregate principal amount of $15 million. Furthermore, all existing options and warrants to purchase our common shares, including certain debenture warrants and exchange warrants previously issued to the Secured Lenders, the warrants previously issued in connection with the Unsecured Debentures and all other Affected Equity (as defined in the Plan of Arrangement), were cancelled and extinguished for no consideration.

Secured Debenture Purchase Agreement

In connection with the closing of the Recapitalization Transaction, we entered into a Third Amended and Restated Secured Debenture Purchase Agreement (the “Secured DPA”), dated as of June 24, 2022, with ICM, the other Credit Parties (as defined in the Secured DPA), the Collateral Agent, and the lenders party thereto (the “New Secured Lenders”) pursuant to which ICM issued the New Secured Lenders 8% secured debentures (the “June Secured Debentures”) in the aggregate principal amount of $99,736,842 pursuant to the Plan of Arrangement.

The June Secured Debentures accrue interest at a rate of 8% per annum (increasing to 11% upon the occurrence of an Event of Default (as defined in the June Secured Debentures)), are due on June 24, 2027, and may be prepaid on a pro rata basis from and after the third anniversary of the Closing Date upon prior written notice to the New Secured Lenders without premium or penalty. Upon receipt of a Change of Control Notice (as defined in the June Secured Debentures), each New Secured Lender may provide notice to ICM to either (i) purchase the June Secured Debenture at a price equal to 103% of the then outstanding principal amount together with interest accrued thereon (the “Offer Price”) or (ii) if the Change of Control Transaction (as defined in Secured DPA) results in a new issuer, or if the

14

New Secured Lender desires that the June Secured Debenture remain unpaid and continue in effect after the closing of the Change of Control Transaction, convert or exchange the June Secured Debenture into a replacement debenture of the new issuer or ICM, as applicable, in the aggregate principal amount of the Offer Price on substantially equivalent terms to those terms contained in the June Secured Debenture. Notwithstanding the foregoing, if 90% or more of the principal amount of all June Secured Debentures outstanding have been tendered for redemption on the date of the Change of Control Notice, ICM may, at its sole discretion, redeem all of the outstanding June Secured Debentures at the Offer Price. As security for the Obligations (as defined in the June Secured Debenture), ICM and the Company granted to the Collateral Agent, for the benefit of the New Secured Lenders, a security interest over all of their present and after acquired personal property.

Pursuant to the Secured DPA, so long as Gotham Green Partners, LLC or any of its Affiliates (as defined in the Secured DPA) hold at least 50% of the outstanding principal amount of June Secured Debentures, the Collateral Agent will have the right to appoint two non-voting observers to our board of directors (the “Board of Directors” or the “Board”), each of which shall receive up to a maximum amount of $25,000 in any 12-month period for reasonable out-of-pocket expenses. In addition, pursuant to the Secured DPA, the New Secured Lenders purchased an additional $25 million of June Secured Debentures (the “Additional Secured Debentures”).

Unsecured Debenture Agreement

In connection with the closing of the Recapitalization Transaction, we, as guarantor of the Guaranteed Obligations (as defined in the Unsecured DPA (as defined herein)), entered into an Unsecured Debenture Agreement (the “Unsecured DPA”) dated as of June 24, 2022 with ICM, the Secured Lenders and the Consenting Unsecured Lenders pursuant to which ICM issued 8% unsecured debentures (the “June Unsecured Debentures”) in the aggregate principal amount of $20 million pursuant to the Plan of Arrangement, including $5 million to the Secured Lenders and $15 million to the Unsecured Lenders.

The June Unsecured Debentures accrue interest at a rate of 8% per annum (increasing to 11% upon the occurrence of an Event of Default (as defined in the June Unsecured Debentures)), are due on June 24, 2027, and may be prepaid on a pro rata basis from and after the third anniversary of the Closing Date upon prior written notice to the Unsecured Lender without premium or penalty. Upon receipt of a Change of Control Notice (as defined in the June Unsecured Debenture), each Unsecured Lender may provide notice to ICM to either (i) purchase the June Unsecured Debenture at a price equal to 103% of the then outstanding principal amount together with interest accrued thereon (the “Unsecured Offer Price”) or (ii) if the Change of Control Transaction (as defined in Unsecured DPA) results in a new issuer, or if the Unsecured Lender desires that the June Unsecured Debenture remain unpaid and continue in effect after the closing of the Change of Control Transaction, convert or exchange the June Unsecured Debenture into a replacement debenture of the new issuer or ICM, as applicable, in the aggregate principal amount of the Unsecured Offer Price on substantially equivalent terms to those terms contained in the June Unsecured Debenture. Notwithstanding the foregoing, if 90% or more of the principal amount of all June Unsecured Debentures outstanding have been tendered for redemption on the date of the Change of Control Notice, ICM may, at its sole discretion, redeem all of the outstanding June Unsecured Debentures at the Unsecured Offer Price. Pursuant to the Unsecured DPA, the Obligations (as defined in the Unsecured DPA) are subordinated in right of payment to the Senior Indebtedness (as defined in the Unsecured DPA).

Pursuant to the Recapitalization Transaction, the Secured Lenders, the Unsecured Lenders and our shareholders were allocated and issued the June Secured Debentures, the June Unsecured Debentures, and percentage of our pro forma common shares, as presented in the following table:

(in ’000s of U.S. dollars) |

|

June Secured |

|

|

Interim |

|

|

June Unsecured |

|

|

Pro |

|

||||

Secured Lenders |

|

$ |

85,000 |

|

|

$ |

14,737 |

|

|

$ |

5,000 |

|

|

|

48.625 |

% |

Unsecured Lenders |

|

|

— |

|

|

|

— |

|

|

|

15,000 |

|

|

|

48.625 |

% |

Existing Shareholders |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2.75 |

% |

Total |

|

$ |

85,000 |

|

|

$ |

14,737 |

|

|

$ |

20,000 |

|

|

|

100 |

% |

15

Registration Rights Agreement

In connection with the consummation of the Recapitalization Transaction, we entered into a registration rights agreement (the “RRA”) dated as of the Closing Date with ICM and certain holders of Registrable Securities (as defined in the RRA) (the “Holders”) pursuant to which we shall, upon receipt of written notice (the “Shelf Request”) from Holders of at least 15% of our outstanding common shares (the “Substantial Holders”), prepare and file (i) with the applicable Canadian Securities Regulators (as defined in the RRA), a Shelf Prospectus (as defined in the RRA) to facilitate a secondary offering of all of the Registrable Securities or (ii) with the SEC, a registration statement on Form S-3 (the “S-3 Registration Statement”) covering the resale of all Registrable Securities. Pursuant to the RRA, subject to certain exceptions, we shall use commercially reasonable efforts to file the Shelf Prospectus or the S-3 Registration Statement, as applicable, as soon as practicable but in no event later than 20 days following the receipt of the Shelf Request. In addition, pursuant to the RRA, the Substantial Holders may request (the “Demand Registration Request”) that we file a Prospectus (as defined in the RRA) (other than a Shelf Prospectus) or a registration statement on any form that we are then eligible to use (the “Registration Statement”) to facilitate a Distribution (as defined in the RRA) in Canada or the United States of all or any portion of the Registrable Securities (the “Demand Registration”) held by the Holders requesting the Demand Registration.

Pursuant to the RRA, subject to certain exceptions, we shall use our commercially reasonable efforts to file one or more Prospectuses or Registration Statements within 20 days following delivery of a Demand Registration Request. Notwithstanding the foregoing, we shall not be obligated to effect more than two Demand Registrations in any fiscal year. Moreover, pursuant to the RRA and subject to certain exceptions, if, at any time, we propose to make a Distribution for our own account, we shall notify the Holders of such Distribution (the “Piggyback Registration”) and shall use reasonable commercial efforts to include in the Piggyback Registration such Registrable Securities requested by the Holders be included in such Piggyback Registration. Furthermore, pursuant to the RRA and subject to certain exceptions, after the receipt by us of a Demand Registration Request, we shall not, among other things, without the prior written consent of Holders of least 66 2/3% of the then issued common shares held by all Holders (the “Requisite Holders”) authorize, issue or sell any common shares or Equity Securities (as defined in the RRA) until the date which is 90 days after the later of (i) the date on which a receipt is issued for the Prospectus or Registration Statement filed in connection with such Demand Registration and (ii) the completion of the offering contemplated by the Demand Registration, provided that in respect of any subsequent Demand Registration Request in any fiscal year, such date shall be reduced to the date which is 30 days after the later of (i) and (ii) above. Moreover, pursuant to the RRA and subject to certain exceptions, we shall not grant registration rights to any other Person (as defined in the RRA) without the prior written consent of the Requisite Holders. In addition, we shall use our best efforts to cause a Registration Statement to be declared effective under the Securities Act as promptly as possible but in no event later than the date which is 30 days (or 90 days if the SEC notifies us that it will “review” the Registration Statement) after the initial filing of such Registration Statement.

Board of Directors

Effective as of the Closing Date, three directors resigned from our Board of Directors, including applicable committees. Pursuant to the terms of the Plan of Arrangement and the IRA (as defined herein), the Secured Lenders have the right to nominate three directors to our Board and the Consenting Unsecured Lenders have the right to collectively nominate three directors to our Board. Specifically, we entered into an Investor Rights Agreement (“IRA”) dated June 24, 2022 with ICM and certain investors (the “Investors”) in connection with the closing of the Recapitalization Transaction pursuant to which the Investors are entitled to designate nominees for election or appointment to our Board as follows:

16

Pursuant to the IRA, the Secured Lenders appointed Scott Cohen, Michelle Mathews-Spradlin and Kenneth Gilbert to serve on our Board. Mr. Cohen and Ms. Mathews-Spradlin’s appointments were effective as of the Closing Date and Mr. Gilbert’s appointment was effective as of August 11, 2022. The Consenting Unsecured Lenders initially appointed Zachary Arrick, Alexander Shoghi and Marco D’Attanasio to serve on our Board effective as of the Closing Date. On September 15, 2022, Mr. D’Attanasio resigned as a member of our Board and audit committee. On February 21, 2023, Mr. Arrick resigned as a member of our Board and compensation and nominating and corporate governance committee. On April 20, 2023, John Paterson was appointed to our Board. Mr. Paterson was nominated as a replacement director for Mr. D'Attanasio by the Investor that initially nominated Mr. D'Attanasio. On March 9, 2024, Mr. Paterson resigned as a member of our Board, audit committee and nomination and corporate governance committee. As of the date hereof, the Consenting Unsecured Lenders have not filled the vacancies on our Board created by Mr. Arrick’s or Mr. Paterson's resignations. The directors appointed by the Secured Lenders and Consenting Unsecured Lenders will serve as our directors until our next annual general meeting of shareholders or until their successors are duly elected or appointed.

Pursuant to the IRA, we are required to hire a chief executive officer (and any successor thereto) who has been unanimously approved by the Investors. Upon the chief executive officer taking office (other than an interim chief executive officer), we are obligated to arrange for the chief executive officer to be appointed to our Board. Accordingly, we appointed Richard Proud as a member of our Board upon his appointment as Chief Executive Officer, which had been unanimously approved by the Investors.

Recent Developments

Issuance of common shares

On January 5, 2024, we issued 21,160,358 common shares for vested RSUs. We withheld 2,300,891 common shares to satisfy employees’ tax obligations of less than $0.1 million.

On February 27, 2024, we issued 61,314,272 common shares to the holders of the Senior Secured Bridge Notes to satisfy the amendment fee pertaining to the NJ Amendment (as defined below).

Extension of INJ Senior Secured Bridge Notes

On February 16, 2024, we entered into an amendment (the “NJ Amendment”) to the senior secured bridge notes (the “Senior Secured Bridge Notes”) originally issued by INJ on February 2, 2021, with all the holders of such notes in the aggregate initial principal amount of $11.0 million and having a maturity date of February 2, 2024. On February 2, 2024, in order to facilitate the NJ Amendment, the parties agreed to a short-term extension of the maturity date from February 2, 2024, to February 16, 2024. Pursuant to the NJ Amendment, the maturity date of the Senior Secured Bridge Notes was extended from February 16, 2024 to February 16, 2026 and the interest rate of the Senior Secured Bridge Notes remains at 12% per annum, but interest accruing after February 16, 2024 will be payable in quarterly cash payments. In addition, the NJ Amendment provides for an amendment fee (the "NJ Amendment Fee") equal to 10% of the principal amount of the Senior Secured Bridge Notes as of the date of the NJ Amendment, which is satisfied through the issuance of our common shares at a price per share equal to the volume-weighted average trading price of the our common shares on the Canadian Securities Exchange for the twenty (20) consecutive trading days immediately prior to the date of the NJ Amendment. As of the date of the NJ Amendment, the aggregate principal amount outstanding on the Senior Secured Bridge Notes is equal to approximately $15.8 million. Lastly, we agreed to utilize twenty-five (25%) of Non-Operational Cash Receipts in excess of $5.0 million to make payments towards the principal amount outstanding under the Senior Secured Bridge Notes, without penalty. For purposes of the NJ Amendment, “Non-Operational Cash Receipts” means cash we received which is not derived from the sale of cannabis products in the ordinary course of business of the Company, whether through retail, wholesale or otherwise.

Disposition of Certain Massachusetts Assets

On February 9, 2024, our wholly-owned subsidiary, Mayflower, entered into an Asset Purchase Agreement (the "MA Purchase Agreement") with an unaffiliated third-party buyer (the "MA Buyer"), pursuant to which, Mayflower agreed to sell certain of its assets associated with its Holliston, Massachusetts cultivation and product manufacturing facility for $3.0 million (the "Purchase Price"). The Purchase Price will be paid as follows: $1.0 million payable in cash at closing and the remaining $2.0 million to be paid in equal monthly installments over 36 months with interest accruing at 7% per annum pursuant to a promissory note. The proceeds from the Purchase Price will be used by the Company to satisfy certain federal tax obligations. The closing of the MA Purchase Agreement is subject to, among other customary conditions, approval of the Massachusetts Cannabis Control Commission.

17

Disposition of Nevada Assets

On February 23, 2024, our wholly-owned subsidiary, GMNV entered into an Asset Purchase Agreement (the "NV Purchase Agreement") with an unaffiliated, third-party buyer (the "NV Buyer"), pursuant to which, GMNV agreed to sell substantially all of the assets of GMNV to the NV Buyer. GMNV currently operates a co-located medical and adult-use cultivation and production facility in North Las Vegas, Nevada and an adult-use dispensary in Las Vegas, Nevada and holds two conditional adult-use dispensary licenses to be located in Henderson and Reno, Nevada (the "Business"). The aggregate proceeds to be received from the sale are $6.5 million (the "Purchase Price"). The closing of the NV Purchase Agreement is subject to, among other customary conditions, receipt of approval of the Nevada Cannabis Compliance Board (the "NV CCB"). On February 23, 2024, GMNV also entered into a Management Agreement (the "NV Management Agreement"), pursuant to which, the NV Buyer's affiliated entity (the "Manager"), will assume full operational and managerial control of the Business, subject to the approval of the NV CCB, which remains pending. Of the total Purchase Price, $3.5 million is paid in cash at the closing of the NV Purchase Agreement ("Closing") and the remaining balance of the Purchase Price is paid on a quarterly basis, beginning three months after the Closing, over 36 months with interest accruing at 8% per annum.

Intellectual Property

Our portfolio of subsidiaries currently includes a number of local and multi-state brands. As cannabis currently remains illegal under U.S. federal law, we cannot register our cannabis brands with the U.S. Patent and Trademark Office. However, we rely on the intellectual property protections afforded under applicable state laws and common law through the use of our marks in commerce in each of the respective regions in which we operate.

Governmental Regulations

Cannabis

In the United States, the cultivation, manufacturing, importation, distribution, use and possession of cannabis is illegal under U.S. federal law. However, medical and adult-use cannabis has been legalized and regulated by individual states. Pursuant to the Congressional Research Service, as of December 31, 2023, (i) nearly all states plus the District of Columbia, Puerto Rico, Guam, and the U.S. Virgin Islands have comprehensive laws and policies allowing for the medicinal use of marijuana, (ii) 10 additional states allow for “limited access medical cannabis,” which refers to low-THC cannabis or CBD oil and (iii) 24 states, the District of Columbia, Guam, the Northern Mariana Islands and the US Virgin Islands have enacted laws allowing the recreational use of marijuana. Notwithstanding the regulatory environment with respect to cannabis at the state level, cannabis continues to be categorized as a Schedule I controlled substance under the CSA. Accordingly, the use, possession, or distribution of cannabis violates U.S. federal law. As a result, cannabis businesses in the United States are subject to inconsistent state and federal legislation, regulation and enforcement.

Under former President Barack Obama, in an effort to provide guidance to U.S. federal law enforcement regarding the inconsistent regulation of cannabis at the U.S. federal and state levels, the U.S. Department of Justice (“DOJ”) released a memorandum on August 29, 2013 titled “Guidance Regarding Marijuana Enforcement” from former Deputy Attorney General James Cole (the “Cole Memorandum”). The Cole Memorandum acknowledged that, although cannabis is a Schedule I controlled substance under the CSA, the U.S. Attorneys in states that have legalized cannabis should prioritize the use of the U.S. federal government’s limited prosecutorial resources by focusing enforcement actions on the following eight areas of concern (the “Cole Priorities”):

In January 2018, under the administration of former President Donald Trump, former U.S. Attorney General Jeff Sessions rescinded the Cole Memorandum. While this did not create a change in U.S. federal law, as the Cole Memorandum was policy guidance and not law, the rescission added to the uncertainty of U.S. federal enforcement of the CSA in states where cannabis use is legal and regulated.

18

Former Attorney General Sessions, concurrent with the rescission of the Cole Memorandum, issued a memorandum (“Sessions Memorandum”) which explained that the Cole Memorandum was “unnecessary” due to existing general enforcement guidance adopted in the 1980s, as set forth in the U.S. Attorney’s Manual (“USAM”). The USAM enforcement priorities, like those of the Cole Memorandum, are also based on the U.S. federal government’s limited resources and include law enforcement priorities set by the Attorney General, the seriousness of the alleged crimes, the deterrent effect of criminal prosecution and the cumulative impact of particular crimes on the community.

While the Sessions Memorandum emphasizes that cannabis is a Schedule I controlled substance under the CSA and states that it is a “dangerous drug and that marijuana activity is a serious crime,” it does not otherwise provide that the prosecution of cannabis-related offenses is now a DOJ priority. Furthermore, the Sessions Memorandum explicitly indicates that it is a guide for prosecutorial discretion and that discretion is firmly in the hands of U.S. Attorneys who determine whether to prosecute cannabis-related offenses. U.S. Attorneys could individually continue to exercise their discretion in a manner similar to that permitted under the Cole Memorandum. While certain U.S. Attorneys have publicly affirmed their commitment to proceeding in a manner contemplated under the Cole Memorandum, or otherwise affirmed that their views of U.S. federal enforcement priorities have not changed as a result of the rescission of the Cole Memorandum, others have publicly supported the rescission of the Cole Memorandum.

Under former Attorney General William Barr, the Department of Justice did not take a formal position on the federal enforcement of laws relating to cannabis. However, prior to his resignation on December 23, 2020, former Attorney General William Barr stated that his preference would be to have a uniform federal rule against cannabis, but, absent such a uniform rule, his preference would be to permit the existing federal approach leaving it up to the states to make their own decision. In addition, former Attorney General William Barr indicated that the DOJ was reviewing the Strengthening the Tenth Amendment Through Entrusting States Act (“STATES Act”), which would shield individuals and businesses complying with state cannabis laws from federal intervention.

On March 10, 2021, the Senate confirmed, President Joseph R. Biden’s nominee, Merrick Garland, to serve as Attorney General in his administration. Furthermore, two of President Biden’s nominees for top positions at the U.S. Department of Health and Human Services (“HHS”) have strong track records of supporting and defending state-legalized marijuana programs. California’s former Attorney General Xavier Becerra, who serves as the head of HHS, vowed to defend California’s legal cannabis market from any potential intervention during the Trump administration. In addition, Pennsylvania’s former Secretary of Health Dr. Rachel Levine, who serves as the Assistant Secretary of HHS, played a pivotal role in the implementation of Pennsylvania’s medical marijuana program. On October 6, 2022, President Joseph Biden announced a three-step program to bring broad changes to federal marijuana policy. As an initial step towards reform, President Biden began the process of pardoning all federal offenders convicted of simple marijuana possession. As a second step, President Biden encouraged Governors to take similar steps to pardon simple state marijuana possession charges. Finally, President Biden directed the Department of Health and Human Services and Attorney General Merrick Garland to “expeditiously” review marijuana’s status as a Schedule I controlled drug under the CSA.

In August 2023 the Department of Health and Human Services recommended to the U.S Drug Enforcement Administration (“DEA”) that cannabis be rescheduled from Schedule I to Schedule III under the CSA. The DEA is currently reviewing and assessing HHS’s recommendation. While the DEA may or may not recommend rescheduling, the White House directive and subsequent HHS recommendation signal an important shift in federal cannabis policy. The US FDA’s recommendation to reclassify cannabis to Schedule III is based in part on findings that cannabis has an accepted medical use in treatment in the US and relatively low potential for abuse. The National Institute on Drug Abuse (“NIDA”), a part of the National Institutes of Health (“NIH”), importantly concurs with FDA’s recommendation to reclassify cannabis. The Congressional Research Service (“CRS”) stated in a report that it expects the DEA to adopt the HHS recommendation, based on its assessment of past precedent. However, while the DEA is bound by the scientific findings of the HHS it is not bound to follow the health agency’s recommendation and can choose to retain cannabis’ Schedule I classification.

A DEA reclassification of cannabis to Schedule III would have significant impacts on the US cannabis industry, including primarily the easing of restrictions on research, the removal of the 280E tax burden, and the reduction of the stigma associated with Schedule I drugs.

Should the DEA reclassify cannabis to Schedule II, the cultivation, manufacture, distribution, and sale of cannabis by state-regulated business that do not produce or sell FDA regulated products would remain illegal under federal law, albeit subject to less strict administrative, civil, and criminal penalties under the CSA. Unless and until the US Congress amends the CSA with respect to cannabis, there is a risk that federal authorities may enforce current US federal law.

In addition, two separate bills were introduced in 2023 specifically regarding the rescheduling of cannabis. The Marijuana 1-to-3 Act of 2023 would serve only to direct the Attorney General to transfer cannabis from Schedule I to Schedule III of the CSA, while the Deferring Executive Authority (“DEA Act”) Act would limit the DEA’s ability to reschedule cannabis without Congressional approval. The DEA Act would require a formal process for Congressional review of all cannabis rescheduling decision made by the DEA. Neither bill has yet passed through committee.

19

Despite the growing enthusiasm in the cannabis business community, it remains unclear whether the Department of Justice under President Biden and Attorney General Garland will re-adopt the Cole Memorandum or effectuate a substantive marijuana enforcement policy change.

Other federal legislation that has historically provided or sought to provide protection to individuals and businesses acting in violation of U.S. federal law but in compliance with state cannabis laws has remained on the books over time. For example, the Rohrabacher-Farr Amendment has been included in annual spending bills passed by Congress since 2014. The Rohrabacher-Farr Amendment restricts the DOJ from using federal funds to interfere with states implementing laws that authorize the use, distribution, possession, or cultivation of medical cannabis.

U.S. courts have construed these appropriations bills to prevent the U.S. federal government from prosecuting individuals or businesses engaged in cannabis-related activities to the extent they are operating in compliance with state medical cannabis laws. However, because this conduct continues to violate U.S. federal law, U.S. courts have observed that should the U.S. Congress choose to appropriate funds to prosecute individuals or businesses acting in violation of the CSA, such individuals or businesses could be prosecuted for violations of U.S. federal law even to the extent/even if they are operating in compliance with applicable state medical cannabis laws.

If Congress declines to include the Rohrabacher-Farr Amendment in future fiscal year appropriations bills or fails to pass necessary budget legislation causing a government shutdown, the U.S. federal government will have the authority to spend federal funds to prosecute individuals and businesses acting contrary to the CSA for violations of U.S. federal law. Furthermore, the appropriations protections only apply to individuals and businesses operating in compliance with a state’s medical cannabis laws and provide no protection to individuals or businesses operating in compliance with a state’s adult-use cannabis laws.

Additionally, there are a number of marijuana reform bills that have been introduced in the U.S. Congress that would amend federal law regarding the legal status and permissibility of medical and adult-use cannabis, including the STATES Act, the Marijuana Opportunity Reinvestment and Expungement Act (the “MORE Act”), the Substance Regulation and Safety Act (the “SRSA”) the States Reform Act of 2023, and the Strengthening the Tenth Amendment Through Entrusting State (“STATES 2.0 Act").

20

The STATES Act would create an exemption in the CSA to allow states to determine their own cannabis policies without fear of federal reprisal. The MORE Act, which was reintroduced to the House of Representatives on May 28, 2021, would remove cannabis from the CSA, expunge federal cannabis offenses and establish a 5% excise tax on cannabis to fund various federal grant programs. The MORE Act was re-introduced in the House in September 2023 and has not yet passed through committee. The SRSA, which was introduced by U.S. Senator Tina Smith on July 30, 2020, would remove cannabis from the CSA, grant the FDA authority to regulate cannabis and cannabis products and regulate the safety and quality control of cannabis crops and the import and export of cannabis materials. The States Reform Act adopts a dual federal-state regulatory model, like the regulation of alcohol. The STATES 2.0 Act would also legalize cannabis but would permit states to maintain their prohibition of cannabis on a state-by-state basis. The Act would also, however, require any opt-out state to permit the interstate commerce cannabis across their border. Both the States Reform Act and STATES 2.0 Act were introduced in late 2023 and neither have passed through committee.

In addition to the foregoing, on December 2, 2022, President Biden signed the Medical Marijuana Research Act (the “MMRA”) into law. The MMRA is a piece of bipartisan legislation and marks the first standalone cannabis reform bill to be signed into law, a significant milestone in the evolution of federal cannabis policy. While the new law does not change marijuana’s status as a Schedule I substance under the CSA, the legislation is intended to: 1) advance research on the potential risks and medical benefits of cannabis, cannabis products, and their synthetic equivalents by streamlining and clarifying the role of the DEA in research; 2) expand sources of research-grade marijuana; 3) promote the commercial development of FDA-approved drugs derived from marijuana and CBD; and 4) ensure that physicians may discuss the potential risks and benefits of marijuana and CBD with their patients.

Two additional bills were introduced in 2023 to facilitate and increase research on cannabis. The Higher Education Marijuana Research Act of 2023, introduced in June, would allow higher education institutions located in states where cannabis is legal to obtain cannabis from the relevant regulatory body for the purposes of biological, chemical, agricultural, or public health research, but would not be allowed to administer cannabis to individuals. The Preparing Regulators Effectively for a Post-prohibition Adult-use Regulated Environment (PREPARE) Act of 2023, introduced in April, would direct the Attorney General to establish a commission to study a “plausible and prompt” approach to the regulation of cannabis at the federal level. Neither Act has yet advanced through committee.

In addition to the numerous aforementioned new bills introduced, additional bills regarding veterans access to cannabis, gun rights and cannabis, rights and benefits-related bills, and hemp and cannabinoids bills were introduced in 2023. Most, if not all, have not yet passed through committee. At this time, it is uncertain which other federal marijuana reform bills, if any, will ultimately be passed and signed into law.

Businesses in the regulated cannabis industry, including our business, are subject to a variety of laws and regulations in the United States that involve money laundering, financial recordkeeping and proceeds of crime, including the U.S. Currency and Foreign Transactions Reporting Act of 1970 (“Bank Secrecy Act”) and the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act (the “US PATRIOT Act”) and the rules and regulations thereunder and any related or similar rules, regulations, or guidelines, issued, administered, or enforced by governmental authorities in the United States. Further, under U.S. federal law, banks or other financial institutions that provide a cannabis business with a checking account, debit or credit card, small business loan, or any other service could be charged with money laundering, aiding and abetting, or conspiracy.

Despite these laws, the Financial Crimes Enforcement Network (“FinCEN”), a bureau within the U.S. Department of the Treasury (“U.S. Treasury”), issued a memorandum on February 14, 2014 (the “FinCEN Memorandum”), which provides instructions to banks and other financial institutions seeking to provide services to cannabis-related businesses. The FinCEN Memorandum explicitly references the Cole Priorities and indicates that in some circumstances it is permissible for banks and other financial institutions to provide services to cannabis-related businesses without risking prosecution for violation of U.S. federal money laundering laws. Under these guidelines, financial institutions are subject to a requirement to submit a suspicious activity report in certain circumstances as required by federal money laundering laws. These cannabis related suspicious activity reports are divided into three categories: marijuana limited, marijuana priority and marijuana terminated, based on the financial institution’s belief that the marijuana business follows state law, is operating out of compliance with state law, or where the banking relationship has been terminated, respectively. The FinCEN Memorandum refers to supplementary guidance in the Cole Memorandum relating to the prosecution of money laundering offenses predicated on cannabis-related violations of the CSA.

The rescission of the Cole Memorandum did not affect the status of the FinCEN Memorandum, and to date, the U.S. Treasury has not given any indication that it intends to rescind the FinCEN Memorandum. While the FinCEN Memorandum was originally intended to work in tandem with the Cole Memorandum, the FinCEN Memorandum appears to remain in effect as standalone guidance. Although the FinCEN Memorandum remains intact, indicating that the U.S. Treasury and FinCEN intend to continue abiding by its guidance, it is unclear whether the Biden administration will continue to follow the guidelines set forth under the FinCEN Memorandum.

In March 2019, the U.S. House of Representatives introduced the Secure and Fair Enforcement Banking Act (the “SAFE Banking Act”) which creates protections for financial institutions that provide banking services to businesses acting in compliance with applicable state

21

cannabis laws. Most recently, on July 19, 2021, the America Creating Opportunities for Manufacturing, Pre-Eminence in Technology, and Economic Strength Act of 2022 (the “America COMPETES Act of 2022”) was introduced in the U.S. House of Representatives. The America COMPETES Act of 2022 includes provisions of the SAFE Banking Act and sets out financial regulations for cannabis-related businesses and revises other aspects of the financial system with regard to cannabis-related businesses. On February 4, 2022, a majority of the U.S. House of Representatives passed the America COMPETES Act of 2022; however, it did not pass the U.S. Senate. The SAFE Banking Act was again introduced in the House and passed as an amendment to the FY 2023 National Defense Authorization Act, but the amendment did not pass in the Senate at the close of the 2022 congressional session. This marked the seventh time that the U.S. House of Representatives have advanced SAFE Banking to the U.S. Senate.

Lawmakers continue to offer various solutions for providing financial relief for cannabis businesses and legal protections for ancillary businesses in 2023. The Secure and Fair Enforcement Regulation (“SAFER”) Banking Act, would provide safe harbor for financial institutions and other ancillary businesses that work with cannabis industry clients. SAFER passed through committee in September 2023 but has not yet been sent to the floor for a full vote. Lawmakers also introduced the Clarifying Law Around Insurance of Marijuana (“CLAIM”) Act, which provides a specific safe harbor for insurance companies that serve the cannabis industry, and the Small Business Tax Equity Act of 2023, which would exempt cannabis sales conducted in compliance with state law from the prohibition of section 280E. Neither have yet passed through committee.

There can be no assurance that state laws legalizing and regulating the sale and use of cannabis will not be repealed or overturned or that local governmental authorities will not limit the applicability of state laws within their respective jurisdictions. In addition, local and city ordinances may strictly limit and/or restrict the distribution of cannabis in a manner that could make it difficult or impossible to operate cannabis businesses in certain jurisdictions.

Hemp

On December 20, 2018, the U.S. Agriculture Improvement Act of 2018 (the “2018 Farm Bill”) was signed into law. Prior to its enactment, the U.S. federal government did not distinguish between cannabis and hemp and the entire plant species Cannabis sativa L. (subject to narrow exceptions applicable to specific portions of the plant) was scheduled as a controlled substance under the CSA. Therefore, the cultivation of hemp for any purpose in the United States without a Schedule I registration with the U.S. Drug Enforcement Agency (“DEA”) was federally illegal, unless exempted by Section 7606 of the Agricultural Act of 2014 (the “2014 Farm Bill”). The 2018 Farm Bill removed hemp (which is defined as “the plant Cannabis sativa L. and any part of that plant, including the seeds thereof and all derivatives, extracts, cannabinoids, isomers, acids, salts and salts of isomers, whether growing or not, with a delta-9 tetrahydrocannabinol concentration of not more than 0.3 percent on a dry weight basis”) and its derivatives, extracts and cannabinoids, including CBD derived from hemp, from the definition of marijuana in the CSA, thereby removing hemp and its derivatives from DEA purview as a controlled substance. The 2018 Farm Bill also amends the Agricultural Marketing Act of 1946 to allow for the commercial production of hemp in the United States under the purview of the United States Department of Agriculture (the “USDA”) in coordination with state departments of agriculture that elect to have primary regulatory authority over hemp production in their respective jurisdictions. Pursuant to the 2018 Farm Bill, states, U.S. territories and tribal governments may adopt their own regulatory plans for hemp production even if more restrictive than federal regulations so long as they meet minimum federal standards and are approved by the USDA. Hemp production in states and tribal territories that do not choose to submit their own plans and that do not prohibit hemp production will be governed by USDA regulations.